MSME Supplier and Input Tax Credit under GST – A Conundrum

By, Mr. Sudeep Manek, Chartered Accountant working in MNC

& Mr. Yogesh Gaba, Practising Chartered Accountant

Confusion, when embraced, is the starting point for discovery, direction, and decision

– Richie Norton

Note: This article was first published by Taxmann in the link – Click here OTU thanks the author and Taxmann for giving consent to publish the same article in this website.

Introduction

We have been hearing for long that the Micro, Small and Medium Enterprises (‘MSMEs’) are the backbone of Indian Economy. Various measures have been taken to strengthen their position in trade and commerce. Unintentionally, one of such measures have created a huge problem for Enterprises procuring goods and services from MSMEs suppliers.

The problem relates to eligibility of Input Tax Credit (‘ITC’) of the recipient where the supplier has not deposited the tax to the Government.

State of Affairs under GST

GST laws require that a recipient is eligible to claim the ITC where its supplier has done following two compliances:

- Declare his supplies in Form GSTR-1; and

- Deposit the tax to the Government

Until the supplier pays the GST to the government, the ITC availed by the recipient shall be treated as provisional. Thus, the vested right in ITC accrues only when the supplier pays the tax to the government.

The issue multiplies when such a condition is coupled with the stipulation that the recipient himself has to prove that the supplier has paid the GST to the Government.

Apart from such stipulations in GST laws, the GST Authorities are empowered to make recoveries for the defaults of supplier from the recipient on following accounts:

a) ITC availed by the recipient; and/or

b) The amount payable to supplier by the recipient for supply

Similar provisions were there under the erstwhile VAT regime wherein the Hon’ble Supreme Court affirmed the Delhi High Court decision in Arise India Ltd. that a bonafide cannot be made to suffer for defaults by a supplier.

The dispute is now pending under GST with various High Courts.

MSME Laws

MSME laws provides that the recipient has to make payment to a MSME supplier within 45 days from the date of actual delivery/rendering of goods/services or in case of an objection made by a recipient within 15 days, the date when such objection is removed by the supplier.

Failure to make payment shall, notwithstanding anything contained in the contract, attract compound interest with monthly rests at three times of the bank rate notified by the Reserve Bank of India, payable by the recipient to the supplier.

Conundrum

Many of the MSMEs are not obligated to generate the e-invoice (falling within Rs. 50 Crores turnover). Further, the small enterprises also fall within the Quarterly filing scheme (QRMP) and accordingly, the follow up can actually be started after the end of three-months’ period. In QRMP scheme, the MSME supplier is allowed to disclose the supplies on monthly basis but is not being obligated to do so. The participation in QRMP scheme implies higher working capital requirement to the MSME and accordingly, does not make a business case.

Further, GST laws provide that a recipient can be asked by GST authorities to stop the payments to the defaulting suppliers. The moot question arises as to whether the recipient can do so given the mandate of MSME laws.

In principle, the commercial power of holding back payments is already lost by the receiver without being able to check on whether the MSME supplier has actually filed the monthly return and deposited the taxes to the Government.

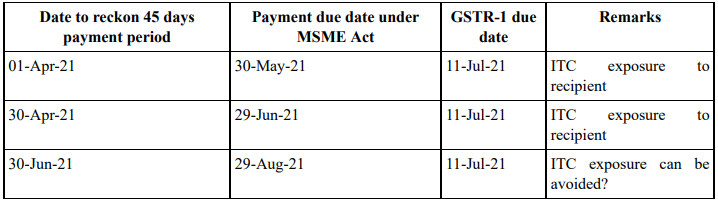

Taking the below practical example should be helpful:

In the first 2 scenarios, the recipient does not have the opportunity to withhold any money post May 30, 2021, whereas he would be able to see the ITC in its GSTR-2A/2B on July 12, 2021.

Further, in the 3rd scenario, the question which still remains as to whether a recipient can hold the money of an MSME supplier where he has not disclosed the supply in his GSTR-1 or not paid the taxes to the Government.

Unfortunately, this dilemma is not hypothetical but a real situation being faced by the recipients procuring from MSMEs.

This non-compliance by some MSMEs will not only affects the customers’ GST problem but also the vendor selection criteria to exclude MSME supplier (unless one doesn’t have any option). This mindset once framed by customers will adversely affect the MSMEs’ business growth.

Discovery, Direction and Decision

The conundrum is not new and well-known to industry at large. The solution, however, is still not there. What can be a solution is also a matter of deliberation. Is an amendment under GST laws required or it has to be under the MSME laws? What provisions can be amended under GST laws/MSMEs laws?

Possible Solutions

Under GST Laws

– Making e-invoicing mandatory for MSMEs; and/or

– Making monthly disclosure of invoices mandatory for MSMEs Under MSMEs Laws

– For an invoice by MSME, making GSTR-1 due date as the date for counting 45 days for payment

– Amending the law to provide for interest and penalties to be imposed on MSMEs supplier in case of GST defaults.

Authors’ Remarks

It is to be seen as to whether the decision of Supreme Court in Arise India Limited (supra) holds the ground under GST laws as well. However, the Doctrine of Impossible Performance (Lex Non Cogit ad impossibilia) surely applies under GST, in the context of MSMEs. In certain cases, it becomes impossible for the recipient to ensure the compliance of Section 16(2)(c) by the supplier.

It is high time that the Government should make suitable amendments either under the GST laws and/or the MSMEs laws. This will not only help the recipients from GST standpoint, but also boost the consumer’s trust in procuring from MSMEs.

—–

Reference

- Section 16(2)(c) of the Central Goods and Services Tax Act, 2017 (‘CGST Act’)

- Section 41 of the CGST Act

- Section 155 of the CGST Act

- Section 79 of the CGST Act

- Arise India Ltd. v. CTT [W.P.(C) No. 2106 of 2015, dated 26-10-2017]

- Section 79 of the CGST Act

By, Mr. Sudeep Manek, Chartered Accountant working in MNC

& Mr. Yogesh Gaba, Practising Chartered Accountant

Share this content:

Post Comment