Soon, you can withdraw up to Rs 5 lakh from EPFO account without manual verification

In March, the CBT’s Executive Committee (EC) had approved the proposal to enhance the ASAC limit to Rs 5 lakh.

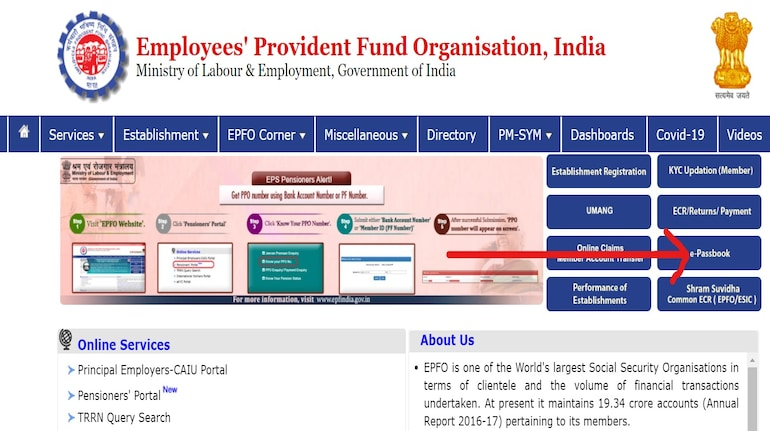

The Central Board of Trustees (CBT) of the Employees’ Provident Fund Organisation (EPFO) is likely to approve next month the raising of auto-settlement limit for advance claims (ASAC) to Rs 5 lakh from Rs 1 lakh currently, two officials have told Moneycontrol, which will enable withdrawal of the amount without needing manual verification.

“The CBT in their next meeting – likely in May – shall grant the approval, granting significant relief to EPFO subscribers,” one official said, on condition of anonymity. EPFO presently has about 7.4 crore active subscribers.

In May 2024, the ASAC limit was increased to Rs 1 lakh from Rs 50,000, which resulted in enhanced ease-of-living for EPFO members, said another person. According to details seen by Moneycontrol, auto-settlement claims (in absolute terms) more than doubled from about 9 million in FY24 to around 20 million in FY25.

In March, the CBT’s Executive Committee (EC) had approved the proposal to enhance the ASAC limit to Rs 5 lakh.

The CBT may also grant approval to withdrawal of EPFO claims via ATMs and UPI starting June, during its next meeting, said another official. The National Payments Corporation of India (NPCI) has built the framework for allowing auto-claim settlement through UPI platforms, the person added.

With an increase in the auto-settlement limit, the members would be able to automatically withdraw up to Rs 5 lakh instantly. At present, members had to wait for manual verification for advance withdrawal of amounts above Rs 1 lakh.

In case of medical emergencies or urgent situations like home renovation and higher education, the funds can now be automatically approved, the sources said. Non-auto settlement requires EPFO subscribers to visit EPFO offices, and wait for manual approval, making the entire process exhaustive.

Akhil Chandna, Partner, Grant Thornton Bharat said, “The increasing of ASAC limit is a welcome move, as Provident Fund account holders will receive quick disbursal in cases of emergency or need of funds, and it will also reduce the administrative burden on the EPFO officials.”

Source: moneycontrol

Share this content:

Post Comment