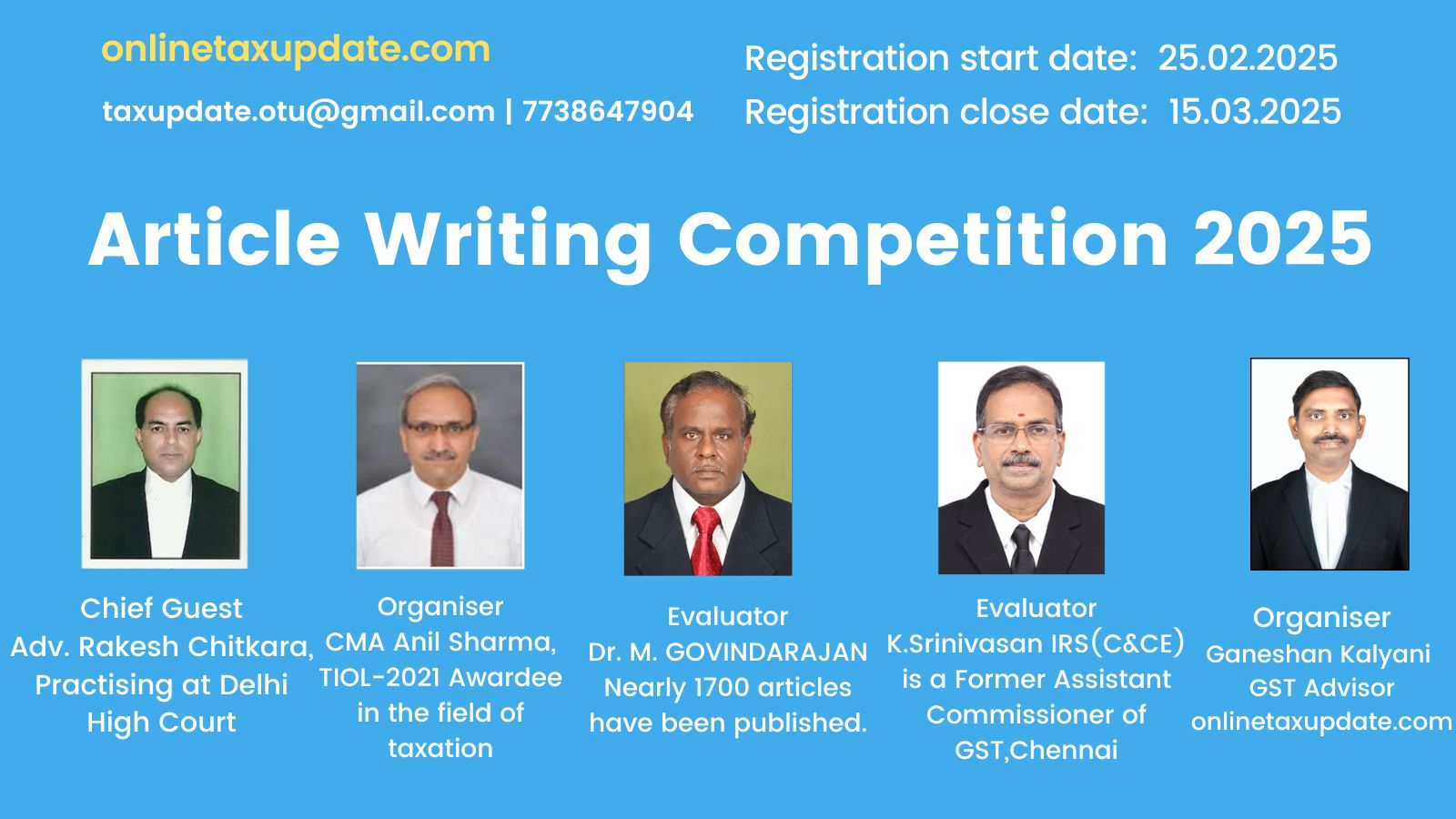

Article Writing Competition 2025

Objective:

Learning is a continuous process and it is an essential ingredient for progress. At the same time, sharing knowledge with professional colleagues is also essential as one learns more while sharing.

One of the ways of sharing knowledge is through Article /write-up/notes etc. It also has a potential of reaching large group of learners and thereby be resourceful to them in upskilling their tax knowledge.

With a view of creating an opportunity to professionals who writes articles or those wanting to write for the first time, we hereby announce the launch of ‘Article Writing Competition 2025’, organized by onlinetaxupdate.com, the detail of same is given below.

PART-A – Committee Members

CHIEF GUEST/ MENTOR

Adv. Rakesh Chitkara, Practising at Delhi High Court

New Delhi based Advocate practicing in High Court & CESTAT. Specialisation in Indirect Taxation (Customs, GST, Service Tax, C. Excise) Civil (Real Estate) & Criminal (CBI). Addresses Seminars & Workshops.

Email: chitkara.advocate@gmail.com. Mobile- 9891678009.

ORGANISING COMMITTEE

CMA Anil Sharma, TIOL-2021 Awardee in the field of taxation,

Author of GST- some perceptions and reflections, Co-Author of Handbook on “GST Audit by Tax Authorities”, Former Chairman -Indirect Tax Committee (ASSOCHAM-North). Also, a practicing Cost Accountant.

Ph:- 09872073456, 0172-2911966

Adv. Ganeshan Kalyani,

onlinetaxupdate.com – stay updated. An online portal that collates tax information at one place for reading and references of tax professionals. It also conducts webinars, courses and circulates e-newsletter on taxation on daily and weekly basis. It has a vision of imparting tax insight to a large group of professionals, taxpayers and knowledge seekers in coming years.

E-mail: taxupdate.otu@gmail.com | Mobile: 7738647904

EVALUTING/MODERATING COMMITTEE

Sri. K. Srinivasan

K. Srinivasan IRS(C&CE) is a Former Assistant Commissioner of GST, Chennai. He writes regularly on Indirect Tax Laws, Macro Economics and General Laws. He is a senior Guest Faculty at NACEN, Chennai and a CBIC Master Trainer of GST. He has trained a large number officers of the Center and State Tax Departments.

Dr. M. GOVINDARAJAN

Company Secretary in practice. Qualification – B.Sc., (Chemistry), M.A., (English), BL, FCS, FCMA, MBA, M.C.A., M.A., (Economics), M.A. (Journalism & Mass Communicatins) Ph.D. Worked Telecom industry nearly 39 years. Having experience in legal, taxation, arbitration, accounts, finance, audit wings. Writing articles regularly. Nearly 1700 articles have been published so far.

Email id – govind.ayyan@gmail.com, Mobile No. 9486103193

Sri K.L.SETHI

A Retd. Superintendent (Central Excise, Customs and Service Tax department (Now CGST) after service of 33 years. Remained posted in Ranges, Audit Wing, Review Branch , Valuation Branch, Preventive Branch, Adjudication Branch, Technical Branch etc.

Email ID : klalsethi@gmail.com

PART-B

About Competition:

GST Law was introduced in the year 2017 by consolidating the erstwhile tax law (complex in nature) to make it simple. But, over a period of time the amendments in the GST Law made it complex and posing challenge to the taxpayers and taxmen as well. And in the process of fixing those issues /glitches by the Government the law evolved even more complex. But anyhow the law has to be abide by the taxpayer and taxman. So there is a need of an experts, practicing professionals, corporate tax team, Government officers and article trainees who has a flair of writing should come forward and write on any topic in the GST Law, GST Portal functionality, GST Administration, Audit, Assessment, Appeal etc. in a simple language so that every professionals in the taxation field understands it with ease and does the compliance in a better way.

Eligibility:

- It is open to all professional experts both Practicing and on Corporate job, CA/CS/ICMAI, Advocate, Government Officer, Article training and Law students as well.

Topic:

- Article should be written on Goods and Services Tax (GST).

Submission Criteria:

- Article must be submitted in word file

- Words limit is between 1000 to 1500

- Should not have been published in any other tax forum/portal

- Co-authoring is not permitted

Author Bio-data:

- Author’s name

- Author’s Profile

- Author’s photo

- WhatsApp number

- E-mail Id

Registration:

- Register your name in the form below

- Participation fee – Rs.200/-

Submission of Article:

- Article must be sent via email at taxupdate.otu@gmail.com in word file with subject line ‘Article WC 2025 | Mobile no.| Topic Tile

- PDF is not allowed

- Font should be ‘Calibri (Body)’ & font size -12

Prize:

- 1st prize – Cash Award of Rs.2,000/- + e-Certificate

- 2nd prize – Cash Award of Rs.1,500/- + e-Certificate

- 3rd prize – Cash Award of Rs.1,000/- + e-Certificate

- All other participants – e-Certificate of Participation

Helpdesk/Support Team:

For any query or clarity reach out to us at (m) 7738647904 / 7506242750 – taxupdate.otu@gmail.com

Thanks

OTU Team

| Article Writing Competition 2025 – Timeline | Date | Revised Date |

| Launch date & Registration start date | 25.02.2025 | same 25.02.2025 |

| Registration close date | 05.03.2025 | 15.03.2025 |

| Article submission last date (article may be submitted from 25.02.2025 or from the date of registration) | 10.03.2025 | 24.03.2025 |

| Article evaluation start date | 11.03.2025 | 21.03.2025 |

| Article evaluation end date | 16.03.2025 | 28.03.2025 |

| Winner selection | 17.03.2025 | 29.03.2025 |

| Result announcement & Prize distribution date (tentative) [online mode] | 21.03.2025 | 21.06.2025 |

Winner Announcement

An online event conducted to announcement the name of the WINNER. It is scheduled on 21st June, 2025 at 3 PM to 4:30 PM via Google Meet.

Share this content:

Post Comment