Bank Accounts section with a new interface

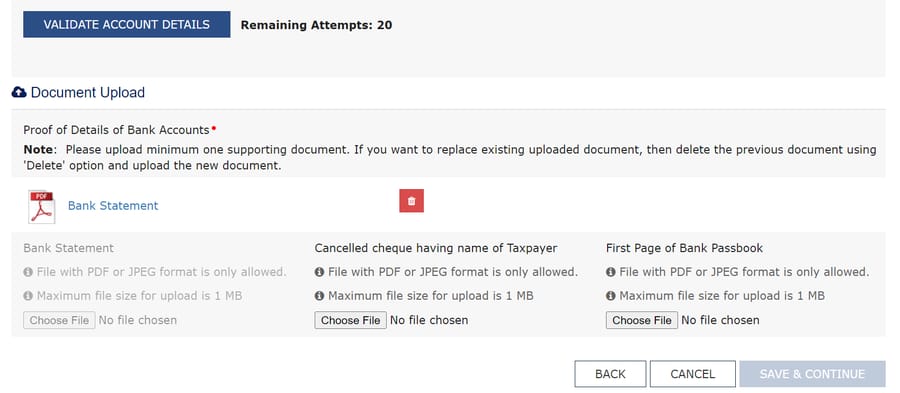

Bank Accounts section under the Amendment of Registration Non-Core Fields has been updated with a new interface as below:

GSTN Advisory

As per Rule 10A of Central Goods and Services Tax Rules, 2017, a taxpayer is required to furnish details of a valid Bank Account within a period of 30 days from the date of grant of registration, or before furnishing the details of outward supplies of goods or services or both in FORM GSTR-1 or using Invoice Furnishing Facility (IFF), whichever is earlier.

Now, from 01st September, 2024 this rule is being enforced. Therefore, for the Tax period August-2024 onwards, the taxpayer will not be able furnish GSTR-01/IFF as the case may be, without furnishing the details of a valid Bank Account in their registration details on GST Portal.

Therefore, all the taxpayers who have not yet furnished the details of a valid Bank Account details are hereby requested to add their bank account information in their registration details by visiting Services > Registration > Amendment of Registration Non – Core Fields tabs on GST Portal.

It is informed that in absence of a valid bank account details in GST registration, you will not be able to file GSTR-1 or IFF as the case may, be from August-2024 return period.

Also read, Advisory for furnishing bank account details before filing GSTR-1/IFF

Share this content:

Post Comment