Benefit of refund cannot be claimed under Inverted Duty Structure relating to manufacturing of non-edible neem oil

The AAR, Uttar Pradesh in the case of In Re. M/s Pooja Solvent Private Limited [Advance Ruling No.UP ADRG 03 Of 2024 dated June 06, 2024] ruled that non-edible neem oil would be classifiable under HSN Code 1515 and the provisions of Notification No. 09/2022-Central Tax (Rate) dated July 13, 2022 (“the Notification”) would be applicable and therefore, the benefit of refund cannot be claimed under Inverted Duty Structure relating to manufacturing of non-edible neem oil.

Facts:

M/s Pooja Solvent Private Limited (“the Applicant”) is into manufacturing of neem cake and chemically modified non-edible neem oil which is used as fertilizers in crop irrigation for essential nutrients (nitrogen, phosphorus, potassium, etc.) fixation to upgrade the quality of soil, also used as pesticides for protection of crops from insects, worms, termites, etc. The oil produced from various processes at various facilities which includes, drying neem seeds, thereafter dried seeds are further crushed to obtain neemgiri, then the neemgiri is further cold pressed to obtain neem oil, which is of high density, which cannot be used for soil irrigation. As per the specification of buyers the density of neem oil is modified by adding various chemicals such as mixed solvent, reducer oil, cashew nutshell liquid, etc. hence making it chemically modified and unfit for human consumption (non-edible). The chemically modified neem oil is transported through tankers for consumption.

The Applicant has filed an application for advance ruling as whether under what HSN Code the non-edible neem oil be classified. Also, the question has been raised as to whether the provisions of the Notification would be applicable on the Applicant as based on applicable GST rates on inputs, input services and outputs, for the Applicant would come within the purview of inverted duty structure as per first proviso to Section 54(3)(ii) of Central Goods and Services Tax Act (“the CGST Act”) as the inputs used during the production such as nitrogen, phosphorous, potassium, etc. are taxed at 18% and 12% and the final output i.e. non-edible neem oil and neem cake are taxed at 5%, thus leading to large amount of input tax credit getting blocked and not refunded due to applicability of the Notification.

Issue:

Whether the benefit of refund can be claimed under Inverted Duty Structure relating to manufacturing of non-edible neem oil?

Held:

The AAR, Uttar Pradesh in the case of Advance Ruling No.UP ADRG 03 Of 2024 held as under:

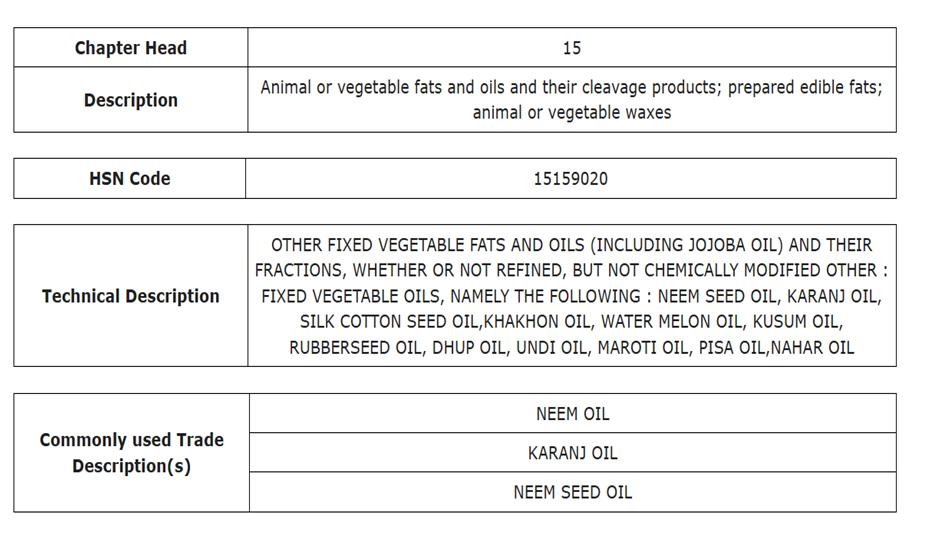

- Noted that, the non-edible neem oil mixed with different solvents resulting in new product which retains neem oil in its essential character. Thus, as per rule 3(b) of General Rules for the interpretation of the Harmonized System, the product “non-edible Neem Oil” is classifiable under HSN code 15159020 and would not fall within the purview of fertilizer under chapter 31 of HSN codes.

- Noted that, as per the Notification no refund of unutilized input tax credit shall be allowed of goods falling under chapters 15 and 27, where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on the output supplies of such specified goods (other than nil rated or fully exempt supplies).

- Ruled that, non-edible neem oil would be classifiable under HSN Code 1515

- Further ruled that, the provisions of Notification would be applicable and therefore, the Applicant cannot claim refund under Inverted Duty Structure.

Relevant Provisions:

Screenshot of GST Portal relating to HSN Code for Neem Oil

Notification No. 5/2017-Central Tax (Rate) dated June 28, 2017 read with Notification No. 09/2022-Central Tax (Rate) dated July 13, 2022

Supplies of goods in respect of which no refund of unutilised input tax credit shall be allowed under section 54(3)

| “1I. | 1515 | Other fixed vegetable or microbial fats and oils (including jojoba oil) and their fractions, whether or not refined, but not chemically modified.” |

CLICK HERE FOR OFFICIAL JUDGMENT COPY

(Author can be reached at info@a2ztaxcorp.com)

DISCLAIMER: The views expressed are strictly of the author and A2Z Taxcorp LLP. The contents of this article are solely for informational purpose and for the reader’s personal non-commercial use. It does not constitute professional advice or recommendation of firm. Neither the author nor firm and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any information in this article nor for any actions taken in reliance thereon. Further, no portion of our article or newsletter should be used for any purpose(s) unless authorized in writing and we reserve a legal right for any infringement on usage of our article or newsletter without prior permission.

Share this content:

Post Comment