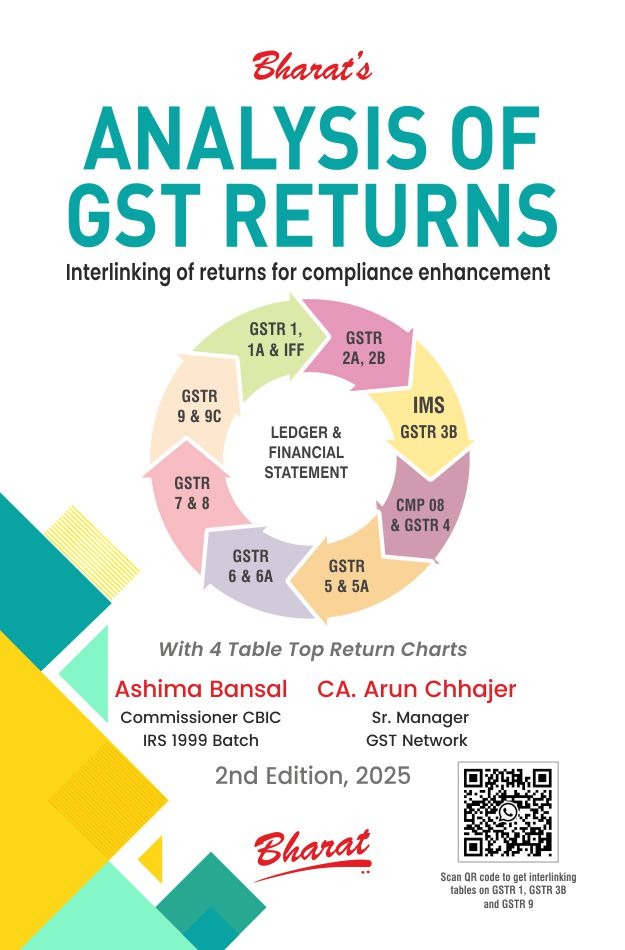

Book: Analysis of GST Returns interlinking of returns for compliance enhancement

Authored by –

- Ms. Ashima Bansal, Commissioner CBIC, IRS 1999 Batch &

- by Mr. CA Arun Chhajer, Sr Manager GST Network

Book title: Book: Analysis of GST Returns interlinking of returns for compliance enhancement

2nd Edition, 2025

| Particular | Price (Rs.) |

| Price | 1195 |

| Less: Discount @ 25% | 299 |

| Offer Price | 896 |

About the Book:

Chapter 1 Overview of GST Return

Chapter 2 Analysis of GSTR 1 and its Interlinking with GSTR 3B, 9 and 9C

Chapter 3 Analysis of GSTR-1A

Chapter 4 Invoice Management System

Chapter 5 GSTR 2A and GSTR 2B

Chapter 6 GSTR 3B and its interlinking with GSTR 1/9/9C

Annexure 1 Due Date Chart for GSTR 3B from July 2017 to December 2024

Chapter 7 Analysis of GSTR 9 and its Interlinking with GSTR 3B, 1 and 9C

Chapter 8 Analysis of GSTR 9C and its interlinking with GSTR 1, 3B and 9

Chapter 9 CMP-08 and GSTR 4 [Composition Levy Scheme]

Chapter 10 GSTR 5 (Non-Resident Taxpayer)

Chapter 11 GSTR 5A (OIDAR and Online Money gaming)

Chapter 12 GSTR 6 and 6A (Input Service Distributor)

Chapter 13 GSTR 7 and GSTR 7A (Tax Deduction at Source)

Chapter 14 GSTR 8 (TCS by ECO)

Chapter 15 Ledgers, Statements and Reports

Chapter 16 Explore the Financial Position: Understanding the P&L, Balance Sheet and Ratio Analysis

Chapter 17 Review of Financial Statements

Also see: A B C of G S T

Share this content:

Post Comment