GST FOR BEGINNERS : Book

Book Name: GST FOR BEGINNERS

Edition: 2nd Edition

Author: Mr. CA Nihalchand J Jain

The author is a Chartered Accountant. He is a Nominated Member of the GST & Indirect Taxes Committee of the WIRC of ICAI for the year 2023-24. He writes and speaks on GST for the members of ICAI of WIRC and NIRC. He also speaks at various professional forums and Government Organisations like Indian Audit & Accounts Department Regional Training Institute, Mumbai (C&AG), the SGST Department (Maharashtra). He also visits academic institutes to speak to students. His members count on WhatsApp is 15K+, on Linkedin 10K, on Twitter 5K, in YouTube it is 2K.

Demo Chapter of the Book

Read the demo chapter of e-book on ‘GST FOR BEGINNERS’.

Pre-booking started

Price:

Rs. 249 only till 25th December, 2023

Rs. 299 only from 26th December, 2023

Don’t miss the discounted price. Place order on or before Christmas Eve i.e. 25th December 2023.

Payment Link:

UPI ID: nihalchandjain93@okhdfcbank

Payment QR code:

Google Form : mandatory

Index of the book:

| SR. NO. | PARTICULARS | PAGE NOs |

| 1. | GST in India – An Introduction | 1 – 9 |

| 2. | Supply under GST | 10 – 37 |

| 3. | Charge of GST | 38 – 57 |

| 4. | Place of Supply (Refer Note Below) | 58 – 81 |

| 5. | Exemptions under GST | 82 – 115 |

| 6. | Tax Invoice, Credit Note and Debit Note | 116 – 129 |

| 7. | E-Invoicing & E-Way Bill under GST | 130 – 149 |

| 8. | Time of Supply | 150 -170 |

| 9. | Value of Supply | 171 – 179 |

| 10. | Accounts and Records | 180 – 184 |

| 11. | Input Tax Credit | 185 – 206 |

| 12. | Registration | 207 – 234 |

| 13. | Payment of Tax | 235 – 253 |

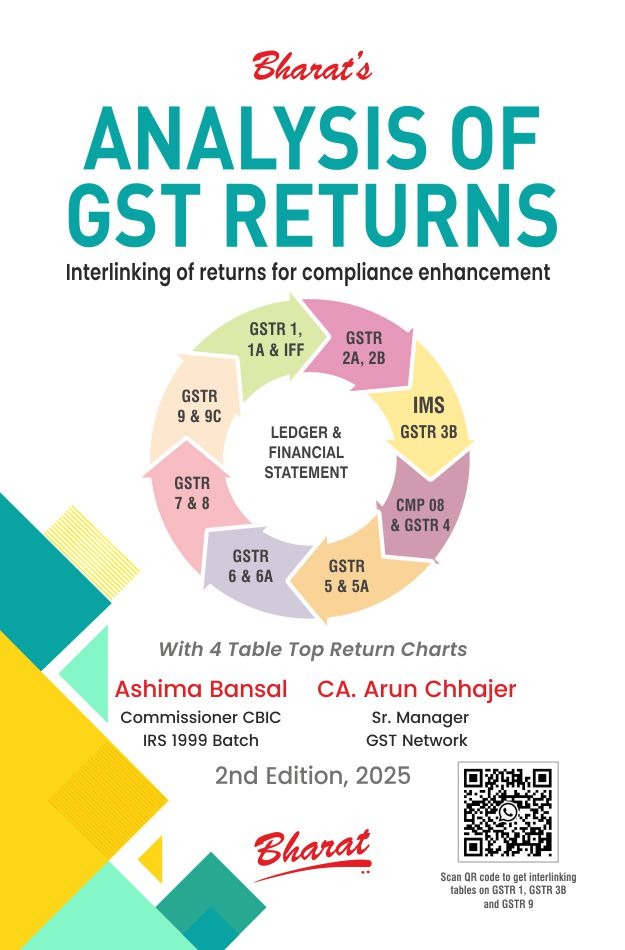

| 14 | Returns | 254 – 274 |

Share this content:

Post Comment