Guidance Notes on – GST Audit under Sec.65 read with Rule 101 and Sec.66 Read with 102 of Goods and Services Tax Act, 2017 Part-1

By, B. S. Seethapathi Rao , Tax Consultant, Kakinada. Dated.12.01.2022.

Dear Colleagues, Good day to you.

I have received suggestions to prepare “Guidance Notes on “ GST Audit under Sec.65 read with Rule 101 and Sec.66 Read with 102 of Goods and Services Tax Act,2017”. I have prepared these guidance notes on the topics of “Scope of the Audit, Statutory Provisions, Administration of GST Audit Wing, Concept of Audit, Procedure of Selection of cases for Audit, Preparation and Verification of Audit file and Construction of Audit Report and Decision of Audit Officer” under Section 65 (1) read with Rule 101(1) to Sec. 65(7)read with Rule 105) of CGST Act and CGST Rules, 2017, for your easy reference. I am trying to prepare this article to the best of my knowledge, based on today’s Act position on the above subject matter for your reference purpose. Kindly refer and provide your suggestions to the mail id. sitapathirao@yahoo.co.in or send to what’s app no. 9848099490.

Definition of Audit under CGST Law, 2017:

As per Section 2(13) of the CGST Act, 2017, ‘Audit’ means the examination of records, returns and other relevant documents prescribed in the CGST Act,2017, whether the tax payer has maintained or furnished by the registered person under this Act or the rules made thereunder to verify correctness of turnover declared and taxes paid there on, input tax claimed by the tax payer and followed compliance with the provisions of the CGST Law.

SEGMENT-1.

Section.1. Scope of the Audit:

Audit is a systematic and independent examination of books of accounts, statutory records, and documents as required by the relevant law applicable to the taxpayer. Audit by the tax authorities entails a deeper scrutiny of tax compliance by a taxpayer from such examination and the effort is not only to ensure that the books of accounts and documents etc., of a taxpayer are maintained as required under the law but they also reflect the correct liability and its compliance thereof.

The objective of audit is not to ensure uniform tax compliance but also to educate the taxpayer and facilitate more voluntary compliance. It is critical and important to ensure compliance in tax administration and prevent revenue leakage and audit is a mechanism in this administration. The reason of this guidance notes on GST Audit is to outline the principles and policies of audits conducted under CGST Act,2017 and Rules made thereunder. The guidance notes provided at this moment is intended to ensure that the audit of taxpayers is carried out in a invariable, efficient and broad manner substance to the stipulated principles, policies and as per the best practical manner.

This guidance notes is an effort to bring together various aspects of audit under the CGST Law for the benefit of Tax Professionals, Tax Payers and GST Audit Team.

What is the necessity and importance of Audit under CGST Law.

Tax liability of a registered person on supply of goods and services or both under CGST Law,2017 is computed by the taxpayer under self-assessment scheme of the Act as provided U/s. 59 of the CGST Act,2017. But, the correctness of such self-assessment on the part of the taxpayer needs to be certify by the tax authority through periodical audit of books of accounts, returns and other relevant documents maintained and furnished by such person to unsure the correctness of turnovers reported, tax liability, claim of ITC in the returns filed and payments of taxes thereon from time to time.

SEGMENT-2.

Statutory Provisions:

Section 65 of Chapter XIII under the heading “AUDIT” of the CGST Act, 2017, and Rule 101 of Chapter XI under the heading “Assessment and Audit” of CGST Rules,2017. Here with I am providing legal provisions relating AUDIT under CGST Act, 2017 and CGST Rules,2017 for your ready reference.

(a). Section 65(1) of the CGST Act,2017, the Chief Commissioner or an officer authorized by him, may undertake audit of any registered taxpayer by issuing a “General or a Special Order”.

(i). General Order shall specify the criteria and all the registered persons fulfilling those criteria shall get covered in the scope of Audit.

(ii). Special Order for audit shall be issued in the name of of a particular registered taxpayer and only such taxpayer shall be subject to audit.

According to Rule 101(1) of the CGST Rules,2017, the period of audit to be conducted under Sec.65(1) shall be a financial year or part thereof or multiples thereof. Consequently, audit need not be conducted for a part of the financial year in normal circumstances. Period to be covered under the audit can be a single financial year or 2 or 3 financial years.

According to Section 65(2) of CGST Act,2017, the authorized officer may conduct audit either at the place of business of the registered person or his own office.

According to Section 65(3) of CGST Act,2017 read with Rule 101(2) of CGST Rules,2017, the registered person shall be informed by way of notice in Form GST ADT-01 at least 15 working days prior to the conduct of audit.

According to Section 65(4) of the CGST Act,2017, audit of a registered person shall be completed within 3 months from the date of commencement of audit. However, if the Commissioner is satisfied that audit of the registered person can’t be completed within 3 onths, he may extend the time period for a further period not exceeding 6 months after recording the reasons for doing so in writing.

Commencement shall means the date on which the books of accounts, records and other documents asked by the audit officer, are made available by the registered person or the date of actual institution of audit at the place of business, whichever is later.

According to Section 65(5) of the CGST Act,2017, the authorized officer, during the course of audit, may require the registered person to (i).provide necessary facility to verify the books of accounts and other documents relating the taxpayer’s business required by him, and (ii). To provide such information as may be required by him for the conduct of audit and to provide assistance for timely completion of audit.

(i) According to Rule 101(3) of the CGST Rules,2017, the proper officer who has been authorized to conduct the audit of the records and books of accounts of the registered taxpayer shall, with the assistance of his team of officers, verify these below records and The documents on the basis of which the books of accounts are maintained,

(ii) The returns and statements furnished under the provisions of the Act and Rules of CGST,

(iii) The correctness of the turnover , exemptions and deductions claimed,

(iv) The correctness of rate of tax applied in respect of supply of goods or services or both,

(v) The ITC availed and utilized,

(vi) The correctness of the refund claimed, and

(vii) Other relevant documents etc. and write down his observations in his audit note.

According to Rule 101(4) of the CGST Rules, 2017, the proper officer may inform the registered taxpayer of the discrepancies, if any, noticed,. The registered taxpayer may file his explanation to discrepancies in his reply. Afterwards, the proper audit officer shall finalize the findings of the audit after contemplation of the reply filed if any.

According to Section 65(6) read with Rule 101(5) of the CGST Act and Rules, 2017, the audit officer, on conclusion of audit, shall ,within 30 days , inform to the registered taxpayer, whose records are audited, about the findings, his rights and obligations and the reasons for such findings in Form GST ADT-02.

According to Section 65(7) of CGST Act, 2017, where audit conducted results in detection of tax not paid or short paid or erroneously refunded or ITC wrongly availed or utilized, the audit officer may initiate action under Section 73 or 74.

According to Section 70 of CGST Act,2017,” Power to summon persons to give evidence and produce documents:-

(i) The proper officer under this Act shall have power to summon any person whose attendance he considers necessary either to give evidence or to produce a document or any other thing in any inquiry in the same manner, as provided in the case of a civil court under the provisions of the Code of Civil Procedure,1908 (CPC) Central Act No.5of 1908.

(ii) Every such inquiry referred to in sub-section (1) shall be deemed to be a “Judicial Proceeding” within the meaning of Section 193 and Section 228 of the Indian Penal Code (IPC) Central Act 45 of 1860.

The audit officer shall exercise these powers judiciously and shall record reasons for issue of summons and draw proceedings relating to the subsequent appearance of such person or production of the documents sought.

According to Section 71 of CGST Act,2017,” Access to business premises:-

(i) Any officer under this Act, authorized by the proper officer not below the rank of Joint Commissioner, shall have access to any place of business of a registered person to inspect books of account, documents, computers, computer programs, computer software whether installed in a computer or otherwise and such other things as he may require and which may be available any such place, for the purposes of carrying out any audit, scrutiny, verification and checks as may be necessary to safeguard the interest of revenue.

(ii) Every person in charge of place referred to in sub-section (1) shall, on demand, make available to the officer authorized under sub-section (1) or the audit party deputed by the proper officer or a cost accountant or chartered accountant nominated under Section 66:-

(i) Such records as prepared or maintained by the registered taxpayer and declared to the proper officer in such manner as may be prescribed;

(ii) Trial balance or its equivalent;

(iii) Statements of annual financial accounts, duly audited, wherever required;

(iv) Cost audit report, if any, under section 148 of the Companies Act,2013 (Central Act 18 of 2013)

(v) The Income tax audit report, if any under Section 44AB of the Income-tax Act,1961 (Central Act 43 of 1961), and

(vi) Any other relevant records.

For the scrutiny by the audit officer or audit party or the charted accountant or cost accountant within a period not exceeding 15 working days from the day when such demand is made, or such further period as may be allowed by the said officer ir the audit party or the chartered accountant or cost accountant.

The audit officer should draw appropriate proceedings relating to demand of any record, statement etc., and their production of otherwise. While non-production of any records etc., sought may result in drawing adverse interference in appropriate cases, action to dela with such non-production may also be initiated.

According to Section.66 of CGST Act,2017. “Special Audit:-

(1) If at any stage of scrutiny, inquiry, investigation or any other proceedings before him, any officer not below the rank of Assistant Commissioner having regard to the nature and complexity of the case and the interest if revenue, is of the opinion that the value has not been correctly declared or the credit availed is not within the normal limits, he may, with the prior approval of the Chief Commissioner, direct such registered person by a communication in writing to get his records including books of accounts examined and audited by a chartered accountant or a cost accountant as may be nominated by the Chief Commissioner.

(2) The chartered accountant or cost accountant so nominated shall, within the period of 90 days ,submit a report of such audit duly signed and certified by him to the said Assistant Commissioner mentioning therein such other particulars as may be specified,

Provided that the Assistant Commissioner may, on an application made to him in this behalf by the registered taxpayer or the Chartered Accountant or Cost Accountant or for any material and sufficient reason, extend the said period by a further period of 90 days.

(3) The provisions of sub-section (1) shall have effect notwithstanding that the accounts of the registered person have been audited under any other provisions of this Act or any other law for the time being in force.

(4) The registered taxpayer shall be given an opportunity of being heard in respect of any material gathered on the basis of special audit under sub-section(1) which is proposed to be used in any proceedings against him under this Act or the rules made thereunder.

(5) The expenses of the examination and audit of records under sub-section (1), including the remuneration of such chartered accountant or cost accountant, shall be determined and paid by the Commissioner and such determination shall be final.

(6) Where the special audit conducted under sub-section (1) results in detection of tax not paid or short paid or erroneously refunded, or input tax credit wrongly availed or utilized, the proper officer may initiate action under section 73 or section 74

According to Rule,102 of the CGST Rules, 2017, “Special Audit”:-

(1) Where special audit is required to be conducted in accordance with the provisions of Section 66, the officer referred to in the said section shall issue a direction in Form GST ADT-03 to the registered person to get his records audited by a chartered accountant or a cost accountant specified in the said direction.

(2) On conclusion of special audit , the registered person shall be informed of the findings of special audit in Form GST ADT.04.

According to Section 73 of the CGST Act, 2017,” Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilized for any reason other than fraud or any willful misstatement or suppression of facts,:-

(1) Where it appears to the proper officer that any tax has not been paid or short paid or erroneously refunded, or where input tax credit has been wrongly availed or utilized for any reason, other than the reason of fraud or any willful misstatement or suppression of facts to evade tax, he shall serve notice on the person chargeable with tax which has not been, or who has wrongly availed or utilized input tax credit, requiring him to show cause as to why he should not pay the amount specified in the notice along with interest payable thereon under section 50 and a penalty leviable under the provisions of this Act or the rules made thereunder.

(2) The proper officer shall issue the notice under sub-section (1) at least 3 months prior to the time limit specified in sub-section (10) for issuance of order.

(3) Where a notice has been issued for any period under sub-section (1), the proper officer may serve a statement , containing the details of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilized for such periods other than those covered under sub-section (1), on the person chargeable with tax.

(4) The service of such statement shall be deemed to be service of notice on such person under sub-section (1), subject to the condition that the grounds relied upon for such tax periods other than those covered under sub-section(1) are the same as are mentioned in the earlier notice.

(5) The person chargeable with tax may, before service of notice under sub-section(1) or as the case may be, the statement under sub-section (3), pay the amount of tax along with interest payable thereon under section 50 on the basis of his own ascertainment of such tax or the tax as ascertained by the proper officer and inform the proper officer in writing of such payment.

(6) The proper officer, on receipt of such information , shall not serve any notice under sub-section (1) or as the case may be , the statement under sub-section(3), in respect of the tax so paid or any penalty payable under the provisions of this Act or the rules made thereunder.

(7) Where the proper officer is of the opinion that the amount paid under sub-section (5) fall short of the amount actually payable, he shall proceed to issue the notice as provided for in sub-section (1) in respect of such amount which falls short of the amount actually payable.

(8) Where any person chargeable with tax under sub-section (1) or sub-section.

(9) Pays the said tax along with interest payable under section 50 within 30 days of issue of show cause notice shall be deemed to be concluded.

10 The proper officer shall , after considering the representation, if any, made by person chargeable with tax, determine the amount of tax, interest and penalty equivalent to 10% of tax or Rs.10,000/- , whichever is higher, due from such person and issue an order.

11 The proper officer shall issue the order under sub-section(9) within 3 years from the due date for furnishing of annual return for the financial year to which the tax not paid or short paid or input tax credit wrongly availed or utilized relates to or within 3 years from the date of erroneous refund.

12 Notwithstanding anything contained in sub-section (6) or sub-section(8) , penalty under sub-section (9) shall be payable where any amount of self-assessed tax or any amount collected as tax has not been paid within a period of 30 days from the due date of payment of such tax.

According to Section 74 of CGST Act, 2017:-“Determination of tax paid or short paid or erroneously refunded or input tax credit wrongly availed or utilized by reason of fraud or any willful misstatement or suppression of facts:-

(1) Where it appears to the proper officer that any tax has not been paid or short paid or erroneously refunded or where input tax credit has been wrongly availed or utilized by reason of fraud , or any willful misstatement or suppression of facts to evade tax, he shall serve notice on the person chargeable with tax which has not been so paid or which has been so short paid or to whom the refund has erroneously been made, or who has wrongly availed or utilized input tax credit , requiring him to show cause as to why he should not pay the amount specified in the notice along with interest payable thereon under section 50 and a penalty equivalent to the tax specified in the notice.

(2) The proper officer shall issue the notice under sub-section (1) at least 6 months prior to the time limit specified in sub-section (10) for issuance of order.

(3) Where a notice has been issued for any period under sub-section (1), the proper officer may serve a statement, containing the details of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilized for such periods other than those covered under sub-section(1), on the person chargeable with tax.

(4) The service of statement under sub-section(3) shall be deemed to be service of notice under sub-section (1) of Section 73, subject to the condition that the grounds relied upon in the said statement , except the ground of fraud, or any willful-misstatement or suppression of facts to evade tax, for periods other than those covered under sub-section (1) are the same as are mentioned in the earlier notice.

(5) The person chargeable with tax may, before service of notice under sub-section(1), pay the amount of tax along with interest payable under Section 50 and penalty equivalent to 15% of such tax on the basis of his own ascertainment of such tax or the tax as ascertained by the proper officer and inform the proper officer in writing of such payment.

(6) The proper officer, on receipt of such information, shall not serve any notice under sub-section (1) , in respect of the tax so paid or any penalty payable under the provisions of this Act or the rules made thereunder.

(7) Where the proper officer is of the opinion that the amount paid under sub-section (5) falls short payment of the amount actually payable, he shall proceed to issue the notice as provided for in sub-section(1) in respect of such amount which falls short ofthe amount actually payable.

(8) Where any person chargeable with tax under sub-section(1) pays the said tax along with interest payable under section 50 and a penalty equivalent to 25% of such tax within 30 days of issue of the notice, all proceedings in respect of the said notice shall be deemed to be concluded.

(9) The proper officer shall, after considering the representation, if any , made by the person chargeable with tax, determine the amount of tax , interest and penalty due from such person and issue an order.

10 The proper officer shall issue the order under sub-section (9) within a period of 5 years from the due date for furnishing of annual return for the financial year to which the tax not paid or short paid or input tax credit wrongly availed or utilized relates to or within 5 years from the date of erroneous refund.

11 Where any person served with an order issued under sub-section (9) pays the tax along with interest payable thereon under section 50 and a penalty equivalent to 50%, of such tax within 30 days of communication of the order, all proceedings in respect of the said notice shall be deemed to be concluded.

Explanation.1– For the purposes of section 73 and this section,-

(i) The expression “ all proceedings in respect of the said notice” shall not include proceedings under section 132,

(ii) Where the notice under the same proceedings is issued to the main person liable to pay tax and some other persons, and such proceedings against the main person have been concluded under section 73 or section 74, the proceedings against all the persons liable to pay penalty under sections 122, 125,129 and 130 are deemed to be concluded.

Explanation.2– For the purposes of this Act, the expression” suppression” shall mean non-declaration of facts or information which a taxable person is required to declare in the return, statement, report or any other document furnished under this Act or the rules made thereunder, or failure to furnish any information on being asked for, in writing, by the proper officer.

According to Rule 101(2) of CGST Act, 2017, Form GST ADT-01 .

The audit officer after verification books of accounts and observations, prepare and issued Form GST ADT-01. After service of Form GST ADT-01 if the taxable person fails to comply with the terms of notice if Form GST Audit-01 or seeks adjournment, further opportunity may be provided by issuing an endorsement as given in the below illustration.

Notice seeking additional information/documents:-

On verification of the books of accounts and documents produced for audit, if the audit officer requires any additional information/documents the same may be sought by issuing a notice to the taxable person.

I. Audit of a registered person shall be completed within 3 months from the date of commencement of audit. However, if the Commissioner is satisfied that audit of the registered person cannot be completed within 3 months, he may extend the time for a further period not exceeding 6 months after recording the reasons for doing so in writing. Maximum period available for completion of audit is 9 months, subject to the extension of time by the Commissioner.

II. Commissioner shall mean the date on which the books of accounts, records and other documents, asked do by the tax authorities are made available by the registered person or the date of actual institution of audit at the place of business, whichever is later.

III. Authorized officer, during the course of audit , may require the register person to:-

(a) Afford him necessary facility to verify the books of accounts or other documents required by him,

(b) Furnish such information as may be required by him for the conduct of audit and to provide assistance for timely completion of audit.

IV. The proper officer who has been authorized to conduct the audit of the records and books of account of the registered person shall, with the assistance of his team of officers and officials, verify:-

(i) The documents on the basis of which the books of account are maintained,

(ii) The returns and statements furnished under the provisions of the Act and Rules,

(iii) The correctness of the turnover, exemptions and deductions claimed,

(iv) The correctness of rate of tax applied in respect of supply of goods or services or both,

(v) The input tax credit availed and utilized,

(vi) The correctness of refund claimed and

(vii) Other relevant issues as per Rule 101(3) of CGST Rules,2017.

V. The proper officer shall record the observations in his audit notes,

VI. The proper officer may inform the registered person of the discrepancies, if any notice furnishing the audit.

After verification, Proper officer shall be issued notice under 65(6) of CGST Act,2017 read with Rule 101(4) of CGST Rules,2017.

Draft Format of Notice :

Government of Central / State

No. Auidt- 1 , Dated. XX/ Year. Office of the ——————of C.T/S.T.

- Name of the taxable person: ———————————–,

- GSTN No: —————————————–,

- Status : ———————————,

- Style of Business:———- (Individual, Partner- ship firm, Company),

- Date if Visit:————————-,

- Tax Periods: ————————– (Form Month & Year to Month & Year),

- Financial Year: ——————————( Financial Year),

- Represented by :—————————–( Name of the authorized person).

Date:__________

Present:–Sri.————

Designation:—————-

M/s.————— with GSTN ————————– having place of business at—————– is a

registered taxable person under the provisions of the CGST/SGST Act,2017. On audit of the

books of accounts maintained and verification of other records and documents, the

following discrepancy is noticed.

- ( Explain and look over the para with supporting facts and law substantiating the point of observation including the liability of interest. Each issue may be discussed para-wise with facts and law and liability to be recorded. More than one issue may also be clubbed in the same notice).

- ————–

- ____________

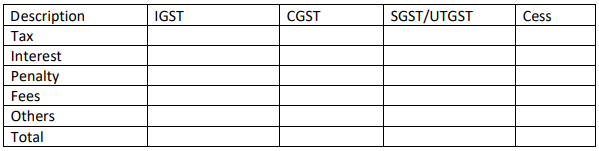

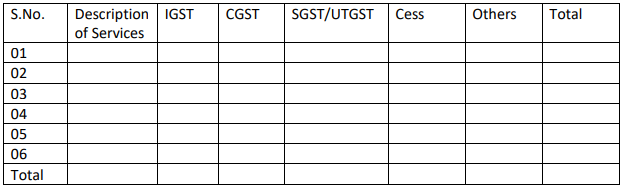

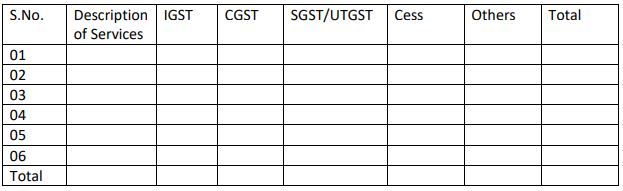

- Details of the additional tax liability accruing out of the above observations made are as under,:

- Objections if any may be filed before this authority on or before——-(Date) along with evidence in support of such objections for the consideration in this audit. If no objections are filed, it shall be presumed that you do not have any objections to offer and the above para shall be incorporated in the audit report in Form GST ADT02, which may please be noted.

Signature of the Proper Officer

The registered person may fiel his explanation to discrepancies in his reply. Thereafter, the proper officer shall finalize the findings of the audit after due consideration of the reply furnished under Rule 101(4). The proper officer , on conclusion of audit , shall with 30 days inform the registered person, whose books of accounts and records are audited, about the findings, his rights and obligations and the reasons for such findings in Form GST ADT-02, along with the detailed report as per Sec.65(6) read with Rule 101(5) of CGST/SGST Act/Rules,2017. However, the audit file of the proper officer should be preserved with the observations made and decisions taken after verifying the objections filed if any and such file may be called in proceedings under Section 108 of the revision authority.

If the audit results in detection of tax not paid or short paid or erroneously refunded , or input tax credit wrongly availed or utilized, the proper officer may initiate action under Sec.73 or Sec.74 of CGST /SGST,UTGST Act,2017, after obtaining the authorization from the authorizing officer or any other authorized officer. The authorizing officer may give the authorization to initiate action under Sec.73 or Sec.74 of CGST/SGST/UTGST Act,2017 to the same officer who has audited or to a different officer

SEGMENT.3:

Administration of Audit Wing

Management at State/ Jurisdiction Level of Audit Wing:

The Commissioner (Audit) / Additional Commissioner of State Taxes (Audit) and Joint Commissioner (Audit) are required to ensure efficient and effective implementation of the audit system and discharge and improve audit techniques and procedures through a periodic review

Commissioner/ Additional Commissioner of Central/State/UTGST (Audit) shall regularly monitor GST audits conducted by the audit officers/audit teams to ensure that the coverage of taxpayers is adequate in number and is reflective of their risk profile and to ensure that these audits are conducted in accordance with the letter and spirit of this manual and as per the established practices and policies.

Once the Audit begins the following procedure shall be followed by the audit officer:-

i. The proper officer who has been assigned the audit shall inform the registered person in the format Form GST ADT-01 and fix up the date and time for visit of audit of the case,

ii. All the names and designations of the Proper officer and other officers and officials authorized to visit the place of business premises for audit shall be recorded in the proceedings sheet with date and time of visit and time of conclusion wit signature of the person representing the case on behalf of the registered person and also the signature of the proper officer who is conducting the audit,

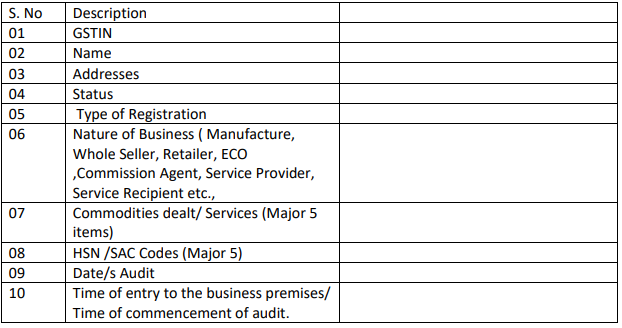

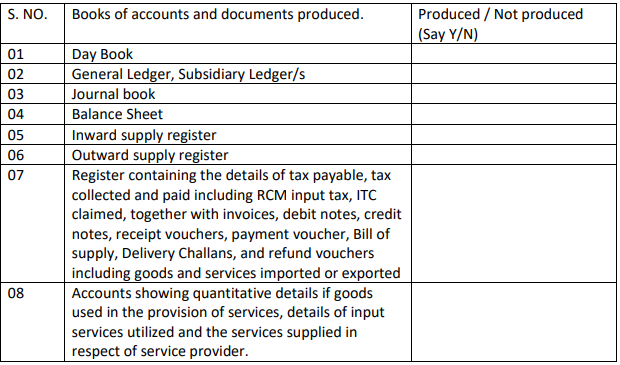

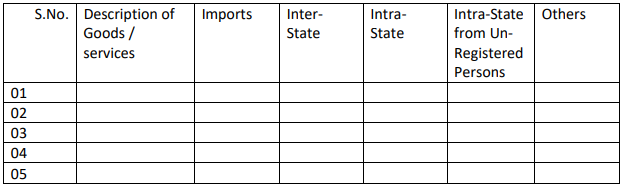

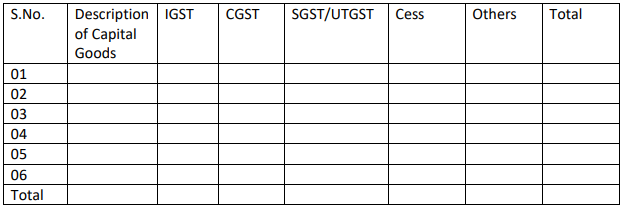

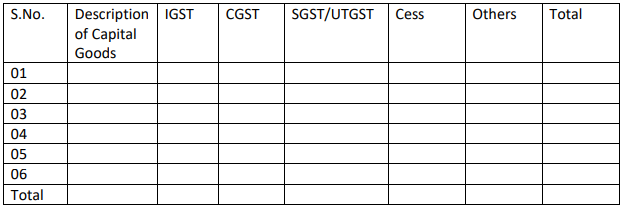

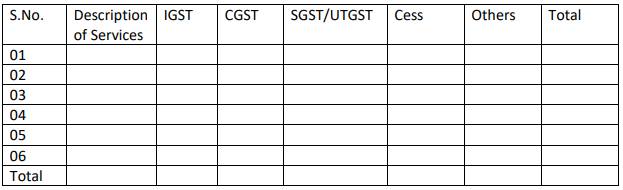

iii. The details of the records verified shall be noted separately in the verification report As per the below Format,(Draft) ,

iv. Proper officer shall record in the proceedings, the discrepancies noted in the records along with relevant provisions/rules/notifications/orders and issue observations to the taxpayer and those observations shall contain details of the tax and other liabilities which are noticed. The taxpayer must be allowed an opportunity to file his reply with regard to the discrepancies and liabilities accruing out of such discrepancies,

v. Proper officer shall conclude the proceedings of audit after consideration of the reply filed. Principles of natural justice shall be followed before concluding the proceedings,

vi. The proper officer , after conclusion of audit, shall inform, the findings of audit to the registered person in Form GST ADT—02 with the details of discrepany, nature of lapse, if any, with referene to the provisions and quantum of liability along with interest and penalty,

vii. Copy of the audit report served on the registered person in Form GST ADT-02 shall be forwarded to the JC /CGST/SGST/UTGST with the details of the assignment no, file no, quantum of liability and nature of discrepancy etc.,

Draft Format of Verification Report:

- Audit Period and Year:

- Name of the Proper Officer:

- Designation:

- Assignment No:

- Team members:

This verification report is required to be maintained in duplicate where in the original is to be retained by the proper officer and the copy shall be furnished to the person in charge of the business premises or the authorized representative who presented the taxable person.

I.General:

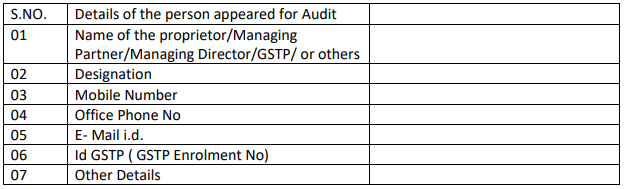

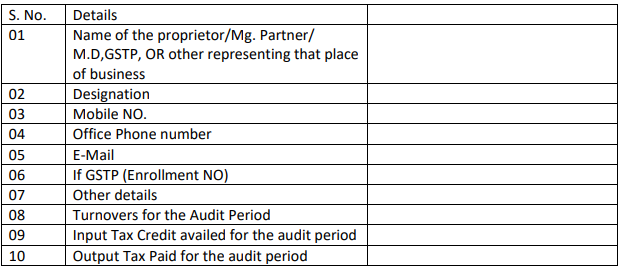

II. Details of the person in charge of the business premises or the authorized representative who presented the taxable person

III. Other Places of Business of the taxable Person:

Note: Separate information for each place of business within the State, Outside of the State or Outside the Country or business verticals as C-1, C-2,C-3,C-4 and C-5.

IV. Books of Accounts and Documents verified:

V. Opening stock of goods: (Values in Rs.):

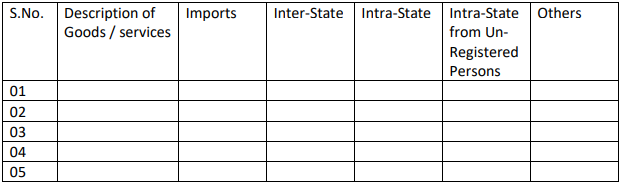

VI . Inward Supplies of Goods ( In Rs.):

VII.Inward Supplies of Services: ( In Rs ):

VIII. Closing Stock of Goods: (In Rs.):

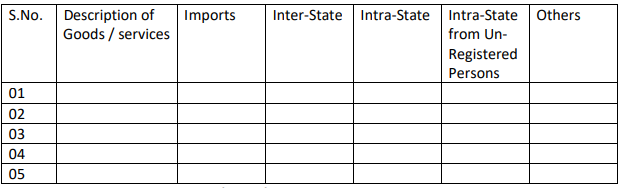

X. Input Tax Credit Details on Capital Goods.( In Rs.):

XI. Input Tax Credit Details on Goods (in Rs.):

XII. Input Tax Credit Details on Services (in Rs.):

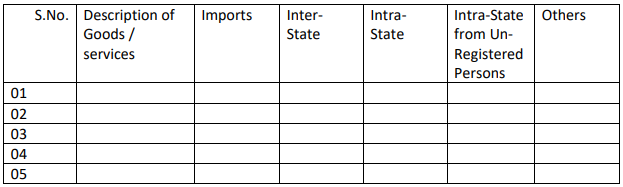

XIII. Output Tax Details on Goods (In Rs.):

XIV. Output Tax Details on Services (In Rs.):

XV. Description of Transactions:

i. Regarding Transition Credit,

ii. Regarding Opening Stock of Goods,

iii. Regarding Closing Stock of Goods,

iv. Applicability of RCM,

v. Utilization of ITC on Capital Goods,

vi. Utilization of ITC relating to Goods,

vii. Utilization of ITC relating to Services,

viii. Applicability of rate of tax with regard to supply of goods and services,

ix. Calculation of output tax with regard to supply of goods and services,

x. Utilization of ITC for discharging liabilities,

xi. Utilization of E-Way bills,

xii. Output Tax paid.

XVI. Details of filling of all Statutory Returns under GST (Y/N) , If no interest and Late Fee details:

I. Form GSTR-3B,

II. Form GSTR-1,

III. Form GSTr-4,

IV. Form GSTR-5,

V. Form GSTR-6,

VI. Form GSTR-7,

VII. Form GSTR-9,

VIII. Form GSTR-9A (If applicable),

IX. Form GSTR-9C

X. Form GSTR-11,

XI. Form CMP-08,

XII. Form ITC-01,

XIII. Form ITC-02,

XIV. Form ITC-)2A,

XV. Form ITC-03,

XVI. Form ITC-04.

XVII.Proper officer &Team observe and noted difference, if any between these following Forms and aspects:-

(i) Form GSTR-1 vs. Form GSTR-3B,

(ii) Form GSTR-3B vs Form GSTR-2A /Form GSTR-2B,

(iii) Values mentioned in E-Way Bills vs Values in Tax Invoices and Form GSTR-3B,

(iv) Refund Claimed/Sanctioned under “Excess Balance in Cash Ledger”,

(v) Refund Claimed/Sanctioned under “Any Other’ Category.

XVIII. Proper officer & Team verify If any inspection or Audit or Penal Actions by Other Authorities like I.T. , Customs, FERA ,FEMA etc.,

(i).

(ii).

(iii).

(iv).

XIX. Proper Officer shall attestation of the books of accounts produced with details ,

(a). Day Book.

(b). General Ledger and Sub-Ledgers,

(c) . Stock Ledger,

(d). Godown Registers etc.,

(e) . I.T.Reports,

(f). ROC records of the taxable person etc.

XX. Proper officer & Team verified further documents/ Reports if any furnished by the taxable person for further verification:-

(i). —-,

(ii).—-,

(iii)—–.

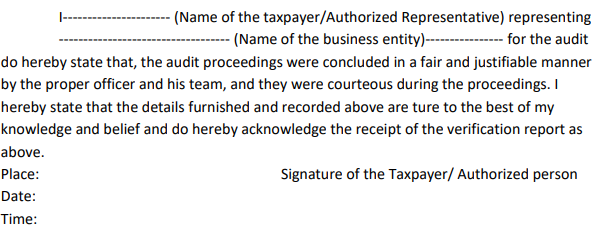

XXI.Declaration of the Taxpayer (Draft ):

NOTE: List of Documents to be submitted/to be kept ready for verification by the taxpayer as per GST-ADT-01 is enclosed as Annexure-1 as attached at the end of this guidance notes:

SEGMENT.4:

CONCEPT OF AUDIT:

The intention of audit of taxpayers is to measure the level of compliance of the taxpayer in the light of the provisions of the GST Act,2017 and the rules made thereunder. It should be consistent with departmental instructions and should make use of professional audit methodology and procedures.

The basic concept of audit is:

a) The audit should be conducted in a systematic manner,

b) Emphasis should be on the identified risk areas and on scrutiny of records maintained in the normal course of business,

c) Audit efforts should be based on materiality and the degree of scrutiny will depend on the nature of risk factors identified,

d) Recording of all checks and findings

e) Audit should normally be distinct from enforcement activity in as much as it can detect irregularities only to the extent of their reflection in the books of accounts and other documents.

Excellence for conduct of audit:

In keeping with the principles of audit outlined above, audit has to be conducted in a transparent and systematic manner with focus on business records of the taxpayer and according to the audit plan for each taxpayer.

The taxpayer participation in the course of audit is also envisaged so that instead of raising purely technical discrepancies (without any revenue implications). Substantive issues are focused upon.

The audit officer should ensure that audit is conducted in a focused manner with optimum utilization of time and resources available at hand. The audit officer must use his judgment and experience to determine the materiality of any discrepancies and / or irregularities observed and decide what action is necessary under the circumstance.

SEGMENT-5.

Procedure of Selection of cases for Audit.

Given the large number of registered taxpayers under GST, it is neither possible nor desirable to subject every taxpayer to audit each year with the available resources. Further, emphasis placed merely on coverage of more number of Taxpayers and taxpayers would dilute the quality of audit and would be against the principles of GST, which is based on trust/voluntary compliance by the tax payers. Selection of taxpayers for audit in a scientific manner is extremely important as it permits the efficient use of audit resources i.e. manpower and skills for achieving effective audit results.

These taxpayers should be selected on the basis of assessment of the risk to revenue. This process, which is an essential feature of audit selection, is known as “Rick Evaluation. It involves the ranking and selections of taxpayers according to a quantitative indicator of risk know as a “RISK BASED SCRUTINY”.

Central Data Analytics cell utilize different analytical tools like Tableau, BIFA etc., to select appropriate cases for conducting audit. Data Analytic Centre will comprise one Deputy Commissioner and two Data Analysts to be nominated by the I.T WING in the office of the Principle Chief Commissioner, CGST/Chief Commissioner of State Tax/UTGST.

SEGMENT-6.

Preparation and Verification of Audit file under AUDIT segment

Audit examines the declarations of taxpayers to not only test the accuracy of the declaration and the accounting systems that produce the declared liability, but also evaluate the credibility of the declared or assessed tax liability . The taxpayer’s anticipation of such actions has preventive and deterrent effects. The deterrent effect is the extent to which audit actions discover and stop taxpayers from continuing to under declare or manipulate their tax liability. The preventive effect is the extent to which registered persons decided ot to evade tax, because they are aware of audit activity and fear of detection by the tax auditor.

An effective audit program generally results in the discovery of under –declared liabilities either by omission, error or deliberate deception. The amount of additional revenue raised depends not only on the level of compliance by the taxpayers, but also on the effectiveness of the auditors and the audit planning and implementation. An efficient and effective audit system will assist the government on its pursuit of increasing taxpayer’s voluntary compliance and facilitate the tax administration’s aim of getting “ Right Tax at the Right Time”.

I .Profiling of taxpayer:

Audit requires a strong database for profiling each taxpayer so that risk-factors relevant to taxpayer may be identified in a scientific manner and audit is planned and executed accordingly. Some of the relevant data can be collected from the taxpayer during the course of audit, while the rest is to be extracted from the registration documents and a return filed by the taxpayer as well as from his annual report, reports/returns submitted to regulatory authorities or other agencies like Income Tax Returns, Contract Copies with his clients, audit reports of earlier periods as well as audits conducted by other agencies, internal audit reports etc,.

A Comprehensive database about taxpayer to be audited is an essential pre-requisite for selection of cases and also the issues for undertaking preliminary desk review and effective conduct of audit.

II. Taxpayer Master File :

The first step towards an effective audit is to collect all relevant information about the taxpayer from various sources, arrange it in a systematic manner so that the audit can be planned in a result-oriented manner. The Taxpayer Master File (TMF) should contain all the useful information about taxpayer, in the form of statistical data as well as in narrative form. This file should be useful not only for the future audits but also as a ready reckoner for other purposes i.e. Litigation Management and General Management Information System (MIS ) Reports.

III. Audit Working Papers:

The working papers form the basis of audit observation. They also show the detailed steps undertaken by the audit officer during the preparation for and conduct of the audit. Therefore, they should be documented and maintained carefully, giving observations and conclusions of the audit officer dult supported by evidence/documents, wherever required.

(i) Each part of the working paper should be filed on completion of the relevant audit step. The date on which such part is completed and working paper filed in should be mentioned. The working papers should be in the custody of the audit officers and must not be shared with taxpayer,

(ii) The completed working papers shall be the basis for Audit Report in Form GST ADT-02,

(iii) Copies of supporting documents/records/evidence referred to in the working papers must be annexed at the end. Each copy should have a cross reference to the relevant entry in the working paper

IV. Desk Review:

The desk review lays emphasis on gathering data about the taxpayer, his operations, business practices and an understanding of the potential audit issues, understanding his financial and accounting system, studying the flow of materials , cash and documentation and run tests to assess the risk areas. The preliminary review assists in development of a logical audit plan and focus on potential issues.

This is the first phase of the audit programme dome in the office. The idea is to gather as much relevant information about the taxpayer and its operations, as much as possible, before visiting the premises. A good desk review is critical to the drawing up of good audit plan.

The audit officer should immediately refer to the Taxpayer Master File (TMF)of previous audit conducted on the same taxpayer. Study of the Taxpayer Master File (TMF) could throw up important points, which may merit inclusion in the audit plan. In addition, the Audit officer should also obtain the latest Balance Sheet, Tax Audit Reports, Annual Financial Statement. Cost Audit Report or any such document prepared or published after the latest updating of Taxpayers Master File (TMF). From the scrutiny of these documents , certain points may further emerge for inclusion in the audit plan.

The audit officer should also incorporate the result of any parameters brought to light by risk analysis into the desk review for pinpointing specific issues for scrutiny during audit.

From the Annual Financial Statements like Profit and Loss Account and Balance Sheet it is possible to work out important financial ratios. The said ratios should be compared with the ratios of earlier year and wherever significant variation is noticed, these areas may be selected for audit verification . It may be kept in mind that any adverse ration is only an indicator for verification of such an area and there may be valid reasons for the same.

Further, the audit officers have to obtain industry/sector specific data and information and compare with the taxpayer audited and any variations which need to be probed into must be included in the Audit Plan. Special emphasis may be laid on the financial rations, manufacturing ratios etc., during the formulation of audit plan

V. Reconciliation of data with third party information:

The payment shown in the GST returns can be reconciled with that shown in the financial accounts. Further, from the reconciled figure of GST payment, value of supplies can be worked out. This can then be compared with the supply figure shown in financial records. The difference, if any, must be analysed. The unit assessable value of the taxpayer can be compared with that of another taxpayer manufacturing/ supplying the same item. This method would give an idea whether the valuation system of the taxpayer is a high/low risk area.

The audit officer should check the data available in returns with other documents such as Gross Trial Balance, Income Tax Returns, Annual Audit accounts, Income Tax Audit Report etc., and carry out a preliminary reconciliation for the purpose of identifying any amount that might have escaped from the payment of GST.

VI. Trend Analysis:

For audit purposes, either absolute values or certain ratios should be studied over a period of time to see the trend and the extent of deviation from the average values during any particular period

VII. Gathering of information of the taxpayer at Audit Visit:

Before start of audit verification , the audit officer should know about the functioning of various areas, such as nature of trade / manufacturing/ service and also areas like marketing , production, purchase, stores and accounts. Such information can be gathered from the heads of various sections of the taxpayer during the visit his business premises. This is used to gather information about the systems adopted or followed by the taxpayer.

A physical tour of the unit/premises provides confirmation of much of the information gathered during previous steps and it also helps resolve issues noted earlier. Often, the tour brings out operations and technical details about inputs/input service used and products / by-products/ wastes manufactured and types of services supplied, some of which may not have been considered during the discussions.

It provides clues about important aspects of the operations of the manufacturing unit of the taxpayer. If necessary, the audit officer should speak to the manager or supervisor/ foreman during the tour.

The audit officer should also go through the working papers prepared in the last audit in order to acquaint themselves with the broad procedures followed by various sections of the taxpayers as part of the desk review. The audit officers may fix appointment with various section heads and during discussions the overall functioning of the taxpayer’s business can be found out and at the same time officers of the company can also explain various procedures adopted by them.

Various types of records maintained for internal control purpose and reports generated by the units can also be found out by the audit officers during discussions. Any important happenings like fire or natural calamity, introduction of new products, overall scenario of industry , new marketing technics, new discounts, action of competitors etc., can also be found out by the audit officer.

Points noticed during desk review can also be enquired at this stage. For this purpose, a sample questionnaire is required to be prepared for discussion in the areas like supply of goods/services w.r.t outward supply/inward supply , stores, tax accounting, job work etc., depending upon the nature of the industry/business .

The following guidelines should be kept in mind at the time of interview:

- Stay in control of the interview,

- Flow a pre-arrangement path of questioning but be flexible,

- Explain questions clearly and ensure that the question has been understood,

- Listen carefully and observe reactions,

- Do not interrupt unless the interview appears to be deliberately changing the subject,

- Avoid ambiguous and leading questions,

- Display confidence and put the audited ease,

- Summarize the interview at the end and seek clarification if necessary.

The purpose of the tour is to gather information from the taxpayer about the various systems followed by him in the different areas of inward and Outward supply, manufacturing, accounting etc., This information can be test-checked by conducting a walkthrough.

VIII. Assessment of the internal controls:

The purpose of review of controls is to assess whether the taxpayer has reliable systems and controls in place that would produce reliable accounting/ business records. Most medium to large companies has ERP systems in place , which account for all transactions from entry of raw material to clearance of final products.

Audit officers must have a look at these systems and more relevantly determine whether software being used exclusively for the transactions related to tax matters is integrated to the main ERP system or is running parallel to the maim ERP. This assessment would be used by the Audit Officer to decide on the extent of verification required and to focus on areas with unreliable or missing controls. It should be noted that this review must be commensurate with the size of operations of the taxpayer.

A small taxpayer might have little in terms of internal controls whereas a large taxpayer would have sophisticated internal controls in place.

If the internal controls are well designated and working properly, then it is possible to rely on the bools maintained by the taxpayer. The scope and the extent of the audit can be reduced in such a case. The reverse would be true if the internal controls are not reliable. Audit should assess the soundness of internal control if sub-systems/areas like inward and outward supply and accounting etc,.

In this regard, an audit officer and his team should normally examine the following:

- Characteristics of the taxpayer’s business and its activity,

- System of maintenance of records and accounts,

- Identifying the persons handling records for accounting purposes,

- Allocation of responsibilities at different levels,

- System of internal checks,

- System of movement of documents having relation to tax assessment,

- Inter-departmental linkages of documents and information,

- System of own internal audit

IX. Techniques for assessment of the Internal Controls

a) Walk Through: This is a process by which the audit officer selects any transaction by sampling method and traces its movement from the beginning through various sub-systems to the end. The audit officer verifies this transaction in the same sequence as it had moved. By this method the audit officer can get a feel of the various processes and their inter linkages. It is also a useful method to assess the internal control system of a taxpayer. The audit officer can undertake walk through process of sales, purchase, account adjustment systems etc. Similarly , key controls may be examined for recording of all cash transactions, these controls may include scrutiny of numbered cash transaction invoices, daily reconciliation of cash invoices, separation of taxes etc,. Undertaking a walk-though and analysis of internal inventory and input controls

during in a scientific manner.

b) Preliminary Visit: In all cases of Desk Audit, audit officer shall issue a notice for visit of the business premises and this visit should be invariably done to have a feel of the industry or business. Later on, the audit of the books of accounts can be carried out in the office of the audit officer.

c) Audit Plan:

(i) The purpose of preparing an audit plan is to outline a logical series of review and examination steps that would meet the goals and standards of an audit in an efficient and effective manner.

(ii) Audit plan is the most important stage before conduct of audit. All the previous steps are actually aimed at preparation of a purposeful audit plan. By now, the audit officer is in a position to take a reasonable view regarding the risk areas , the weak points in the systems, abnormal trends and unusual occurrences that warrant detailed verification. Certain unanswered or inadequately answered queries about the affairs of the taxpayer may also be added to this list.

(iii) Audit plan should be a detailed plan of action. The audit plan should be consistent with the complexity of the audit

X. Audit Verification:

The intention of audit verification is to perform verification activities and document them in order to obtain and record audit evidence. The verification techniques must be appropriate for audit objectives identified in the audit plan, it is important that in an audit, the objections that are raised are technically correct and stand up against scrutiny or challenge.

Law being open to interpretation and dynamic, it may be difficult to test the technical correctness of all discrepancies noticed / raised. However, it should be correct to the extent that any professional audit officer, working with and having access to the same research material would likely to come to the same conclusion. It also means that the audit officer must demonstrate, in writing, the research and reasoning used to base his/her application of legislation , policies and jurisprudence.

Audit verification involves verification of data and actual verification of documents submitted at the time of desk review , verification of points mentioned in the audit plan.

XII, Verification of points mentioned in the audit plan:

The audit officer should conduct the verification in a systematic manner, following the sequence of steps envisaged in the working papers. While conducting audit verification, special care should be taken to examine all those issues pointed out in the audit plan. The audit officer should try to determine whether the apparent weakness in the internal control system of the seller/distributor/ manufacturer /service provider have led to any loss of revenue. He should also identify the procedural infractions on part of the taxpayer, which are recurrent in nature and which may unknown a significant fact. During the process, he must cross check the entries made by the taxpayer in various records and note discrepancies , if any, in all cases involving discrepancies, the audit officer should make detailed enquires regarding the cause of the discrepancies and their revenue implication. The audit officer should also examine the documents submitted to various Government departments/Regulatory Authorities such as Customs, Income Tax, Banks etc., by the taxpayer. This should be used in cross verification of the information filed by the taxpayer for the GST assessment.

Substantial use of information available with open sources such as electronic and print media, internet etc., should also be resorted to for verification of information filed by the taxpayer.

The audit verification gives maximum opportunity to the audit officer to go through the taxpayer’s records in his unit. Therefore , audit officer may come across a new set of information or documents, not earlier known, during any of the earlier stage. Further, while examining an issue, the audit officer may come across a fresh issue also requiring detailed examination. In such a situation, the audit officer should go beyond the scrutiny forecast under the audit plan and record the reasons for doing so.

In spite of audit verification being a structured process, it should be flexible enough to accommodate the needs on the spot.

At the end of each entry in working papers, Audit Office must indicate the findings. If any of the planned verifications is not conducted, the reasons for the same must also be recorded. While the process of verification for each audit would be unique in terms of Audit Plan, it should involve some general steps as discussed below:

XIII. General Steps in audit verification:

a) Physical Verification of Documents: All important documents are already verified at the time of desk review. However, in case of any discrepancy noticed and pointed out in the Audit in the Audit Plan, a detailed scrutiny of the financial records of the taxpayer becomes imperative. The documents to be examined include Annual Accounts Containing Director’s Report, Statutory Audit Officer’s Report, Balance Sheet and Profit and Loss Account. If necessary , the audit officer must go into details of the figures mentioned in the Annual Financial Statements and for that he must examine Trial Balance, Ledgers, Journal Vouchers and Invoices. He may also examine Cash Flow Statement , Groupings, Cost Audit Report and Tax Audit Report. He should also check whether the taxpayer is maintaining the statutory records as required under various statutes especially under the Companies Act,2013.

Audit objections raised must be fully supported by documentary and legal evidence. This will greatly help in explaining and discussing the objections with the taxpayer and other follow up action. It needs to be ensured that all audit documentation is complete, accurate and of professional quality

Working Papers are a synopsis of audit operations conducted by the Audit Group. Entry of all items mentioned in the audit plan must be made in the working papers, during Audit Verification . Working papers should support the audit effort and result. They should:-

a. Be clear, concise , legible , organised, indexed and cross –referenced, b. Disclose the audit trail and techniques used in the examination of each signification item,

c. Support the conclusion reached and cover all queries raised, d. Include audit evidence (e.g. copy of a financial statement, an invoice, a contract, a bank statement, etc) to support the assessment,

e. Link results to supporting working papers e.g. the objections identified in the working papers must agree with the summary of audit results or statement of audit objections and the audit report,

f. See that audit reports are clear and disclose all material and relevant information, and

g. Take follow up action

Apparently, the financial and other documents maintained by the taxpayer fr his private use and in compliance of other statutes are of great importance which may reveal substantial short/non-payments of tax. The Audit Officer may take note of the same during Gathering Information about the taxpayer and the system followed by him and goes through them during “Audit Verification”

XIV. Inform to the taxpayer of irregularities noticed and obtaining his explanations:

It is important that the Audit Officer discusses all the discrepancies noticed with the taxpayer before preparing draft audit report. The taxpayer should have the opportunity to know the discrepancies and to offer explanations with supporting documents. This process will resolve potential disputes at an early stage and avoid unnecessary litigation. The ultimate aim of conducting an audit is to increase the level of tax compliance of taxpayer. Therefore, no audit can be considered to be complete unless the Audit Officer has made all efforts to ensure maximum recovery of short levy before leaving the premises of the taxpayer.

As the audit system adopts a transparent methodology , it is necessary that all the discrepancies notices by the Audit officer are recovered to the taxpayer with a view to obtain his explanations before preparing the Audit Report. Accordingly, the discrepancies noticed should be intimated in writing to the taxpayer, clearly stating that the same is not in the nature of any show cause notice and is only a part of participative and fact-finding audit scheme under which even the preliminary and tentative audit observations are being shared with the taxpayer for obtaining his explanations.

Where satisfactory explanation or evidence is submitted to the Audit Officer, the findings should be revised as necessary.

However, if a response from the taxpayer is not forthcoming, audit paras should be prepared on the basis of available records after citing the lack of cooperation on part of the taxpayer, in the audit report.

It is the Audit Officer’s responsibility to explain all the observations to the taxpayer and to make all attempts to resolve any disagreements before those are finalized. It is also the audit officer’s responsibility to make sure that the senior officers are aware of potential disagreement and the position taken by the taxpayer.

XV. Suggestions to Taxpayer for future compliance:

Before leaving the taxpayer’s premises, the audit officer must discuss future compliance issues with the senior management of the taxpayer. The audit officer should also discuss the steps that management can take to reduce specific errors detected during the audit and to improve compliance by suggesting improvements in the accounting systems etc.

Written or verbal assurances as given by taxpayer should be recorded in the Audit Report. If, in any way, the department can assist the taxpayer to reduce errors and improve compliance, such offer of assistance should be made

SEIGMENT- 7.

Preparation of audit report and determine tax liability of Taxpayer

I) After completion of audit verification, the Audit Officer should prepare the verification report for all issues identified in the Audit Plan. This document should record the results of verification conducted as per the audit plan. Any additional issue verified/point notices should also be mentioned. The audit officer would then discuss each od such issues with the taxpayer pointing out either non-payment or procedural infractions. The initial views of taxpayer must be recorded in the verification document. The audit officer should also apprise the taxpayer of the provisions relating to applicability of interest and encourage him to take advantage of those provisions in order to avoid disputes and litigation.

II) Whether the taxpayer is in agreement with the short levy/ excess claim of Input Tax Credit (ITC), as noticed, the audit officer should explain the benefit available under Section 73(5) or Section 74(5) of the CGST Act,2017, as case may be and use conversion as a measure of recovery of dues along with interest, if any, promptly. Details of spot recoveries and willingness of the taxpayer to pay short levy should also be recorded. This document would then become the basis for preparation of the draft audit report.

III) The narrative of the observations in the audit report in the Form GST ADT-02 should be concise, to the point and self –contained and should convey the adverse observations made. Where the observations are based on any circulars or clarifications issued by the CBIC or SGST department they should not be quoted. Cases, in which certain specified conditions are not fulfilling, giving rise to observations, should be clearly brought out. Similarly, where observations are backed by interpretations as decided by court judgment, decisions of Appellate Authorities or supported by technical literature, those should be cited.

IV) The audit report should be finalized within the shortest time spam. A copy of the audit report , even if it is a No Discrepancy Report. Should be sent to the taxpayer, by e-mail and / or letter and necessary records confirming such action should be kept in Taxpayer Master File (TMF).

Follow up action and issue of show cause notice:

An audit observation should be closed after requisite action, i.e. either recovery of amounts due or issuance of show cause notice, has been taken on it. After the issuance of Audit Report , wherever further action such as issue of Show Cause Notice is required, the audit officer should prepare the show cause notice and take assessment process U/s. 73 or 74 and recover the amount due.

I. Pre-Notice Consultation: (As per section 73(5) or 74(5) read with Rule 142(A) and Form DRC-01A).

a) Every taxpayer has a right in law to be given “Final Opportunity” to discharge due “Before Any Notice” is issued. This is a statutory requirement under section 73(5) and Sec.74(5) of SGST Act,2017 for taxpayer to be given an opportunity to discharge dues without penalty or reduced penalty to put an end to the dispute about the said dues.

b) Amount payable may be ascertained by taxpayer or by tax authority, As such, it is important for the computation of dues to be made by the authority. Statement in DRC-01A is the prescribed document to inform taxpayer about the tax, interest and penalty, if any , payable . Format of DRC-01A requires “grounds and quantification” of ascertainment by tax authorities to be provided. This would “Inform” taxpayer about the basis for such dues and based on this information, taxpayer may consider accepting to “pay dues without contest”.

c) Pre-notice consultations without disclosure of “Grounds and Quantification” will not be considered as legal and by-passing pre-notice consultation would lease the subsequent show cause notice as illegal. There have been decisions in other tax regimes where the show-cause notice consultation proceedings. For this reason, pre-notice consultations are mandatory for tax authorities to follow and it is an enforceable right of taxpayer

d) Once DRC-01 A is issued, taxpayer is permitted to make ‘submission “ containing clarification with regard to the “Grounds” in respect of the said dues. If the submissions by taxpayer provide necessary clarification and thereby resolve the issue then, tax authorities may take the same on record and conclude proceedings initiated. If the clarifications are not completely satisfactory, the taxpayer’s reply “accepting or rejecting” this final opportunity would then allow tax authority yo proceed with show cause notice under section 73(1) or 74(1) of CGST /SGST Act,2017.

e) Care must be taken that “ Submission” in respect of DRC-01A does NOT mean that taxpayer will submit detailed arguments. Tax authority us free to initiate these proceedings under Sec.74(5) instead of Sec.73(5) without disclosing the reasons for invoking section 74 of the CGST/SGST Act,2017. Submissions by taxpayer in respect of DRC-01A must be confined to “Grounds” for the underlying dues to be raised and not on matters of law. These Pre-notice consultation proceedings are NOT a substitute for detailed adjuration proceedings. It is an opportunity to “INFORM” the grounds and seek “RESPONSE” from taxpayer on the dues involved. Taxpayer is free to “accept or reject” and then avail the “due process” of law in the form of show cause notice and adjudication.

f) Actions to be followed: Include reference number of DRC-01A in show cause notice so that it is clear to taxpayer, adjudicating authority and appellate authorities that pre-notice consultations have been conducted and taxpayer has “rejected” the opportunity to resolve the dispute.

g) Actions NOT to be follow:

i). Show-cause notice may NOT be issued before issuing DRC-01A,

ii). DRC_01/DRC-01A must not be issued with “undisclosed” grounds for dues,

iii). DRC-01/DRC-01A is not an adjudication proceeding but an intimation proceeding to allow taxpayer to avail the concessional treatment in section 73(5) or Sec.74(5) of CGST /SGST Act,2017.

Show-cause Notice: (Refer Sections 73, 74 and 76 read with Rule 142 and Form DRC-01 and DRC-02):

h) Every demand for tax or other sum under CGST/SGST Act must ne accompanied by a show cause notice . Various provisions prescribe that show-cause notice is to be issued. When GST portal prescribes format of notice, generally, it DOES NOT refer to show cause notice. If a prescribed notice is applicable , then the notice may be issued in that format. But, if show cause notice is required to be issued, then points discussed in this segment will be very helpful. Show cause notice is compulsory even if the demand for dues is obvious and there is no requirement for detailed hearing or discussion. After completion of pre-notice consultation, show cause notice is the first step to et the “Due Processes” of Law into motion.

i) Show cause notice lays down the “ Framework” for the rest of the life of that issue until it is finally resolved. No adjudicating authority or appellate authority can fill in any banks in the show cause notice. If something important is missed out from the show cause notice , the demand must be dropped in adjudication and a fresh show cause notice will have to be issued but within the limitation time prescribed.

Communication and Service of Notice: (Refer Sections 169);

j) While it is important to issue notices to set the law in motion and to put taxpayer at notice about the proceedings proposed to be undertaken, unless such notices “reach taxpayer, all effort would be wasted. Concept on reaching communication to taxpayer is called “served” of notice, that is , to verify whether the notice has been “served” on the taxpayer.

k) GST regime has introduced “service by email” for audit purpose. When a taxpayer has submitted an “ authorized email “ then as per the Information Technology Act,2005, service by email is valid service if sent to such email address.

l) Section 169- Service of notice in certain circumstances:-

(i) Any decision, orders, summons, notice or other communication under this act or the rules made thereunder shall be served by anyone of the following methods, Namely:-

(a) By giving or tendering it directly or by a messenger including a courier to the addressee or the taxable person or to his manager or authorized representative or an advocate or a tax practitioner holding authority to appear in the proceedings on behalf of the taxable person or to a person regularly employed by him in connection with the business , or to any adult member of family residing with the taxable person.

(b) By registered post or speed post or courier with acknowledgment due to the person for whom it is intended or his authorised representative, if any, at his last known place of business or residence, or

(c) By sending a communication to his e-mail address provide at the time of registration or as amended from time to time,or

(d) By making it available on the common portal, or

(e) By publication in a newspaper circulating in the locality in which the taxable person or the person to whom it is issued is last know to have decided , arrived on business or personally worked for gain, or

(f) If none of the modes aforesaid is practicable for any reason, then by fixing a copy thereof on the notice board of the officer of the concerned officer or authority who are which passed such decision or order or issued such summons or notice.

ii). Every decision , order , summons, notice or any communication shall be deemed to have been served on that date on which it is tendered or published , or a copy thereof is affixed in the manner provided in sub-section(1).

iii) . When such decision, order, summons, notice or any communication is sent by registered post or speed post, it shall be deemed to have been received by the addressee at the expiry of the period normally taken by such post in transit unless the contrary is proved. Section 160(2) of CGST/SGST Act,2017, “ The service of any notice, order or communication shall not be called in question, if the notice, order or communication, as the case may be , has already been acted upon by the person to whom it is issued or where such service has not been called in question at or in the earlier proceedings commenced, continued or finalized pursuant to such notice, order or communication

With this non-service cannot be challenged in appellate proceedings:

N) But where ex-parte orders are passed care must be taken to ensure that service of notices is well documented on the files. As discussed earlier about principles of natural justice, service of notice is a first step in giving the taxpayer an opportunity to defend the proposition in such notice and to finally allow party to be heard. All these are part of one principle is “ listen to the other side”.

Relevant Date:

O). Section 73(2) of CGST Act, 2017, the proper officer shall issue notice under subsection (1) at least 3 moths prior to the time specified in sub-section (10 ) for issuance of order. Section 73(10) of CCST Act,2017, The proper officer shall issue the order under sub-section(9) of CGST Act,2017, within 3 years from the due date for furnishing of annual return for the financial year to which the tax not paid or short paid o input tax credit wrongly available or utilized relates to or within 3 years from the date of erroneous refund.

Section 74(10) of CSGT Act,2017, The proper officer shall issue the order under subsection (9) within a period of 5 years from the due date for furnishing of annual return for the financial year to which the tax not paid or short paid or input tax credit wrongly availed or utilised relates to or within 5 years from the date of erroneous refund.

continued in next part… Part 2

Share this content:

1 comment