Latest update 19.02.2025

Webinar:

by Adv (CA) Arup Dasgupta

Handbook

Handbook-on-Reverse-Charge-under GST-Feb25 – GST & Indirect Taxes

Committee of The Institute of Chartered Accountants of India, published Second Edition in Feb 2025.

Central Board of Indirect Taxes and Customs (CBIC) issued Customs Manual 2025.

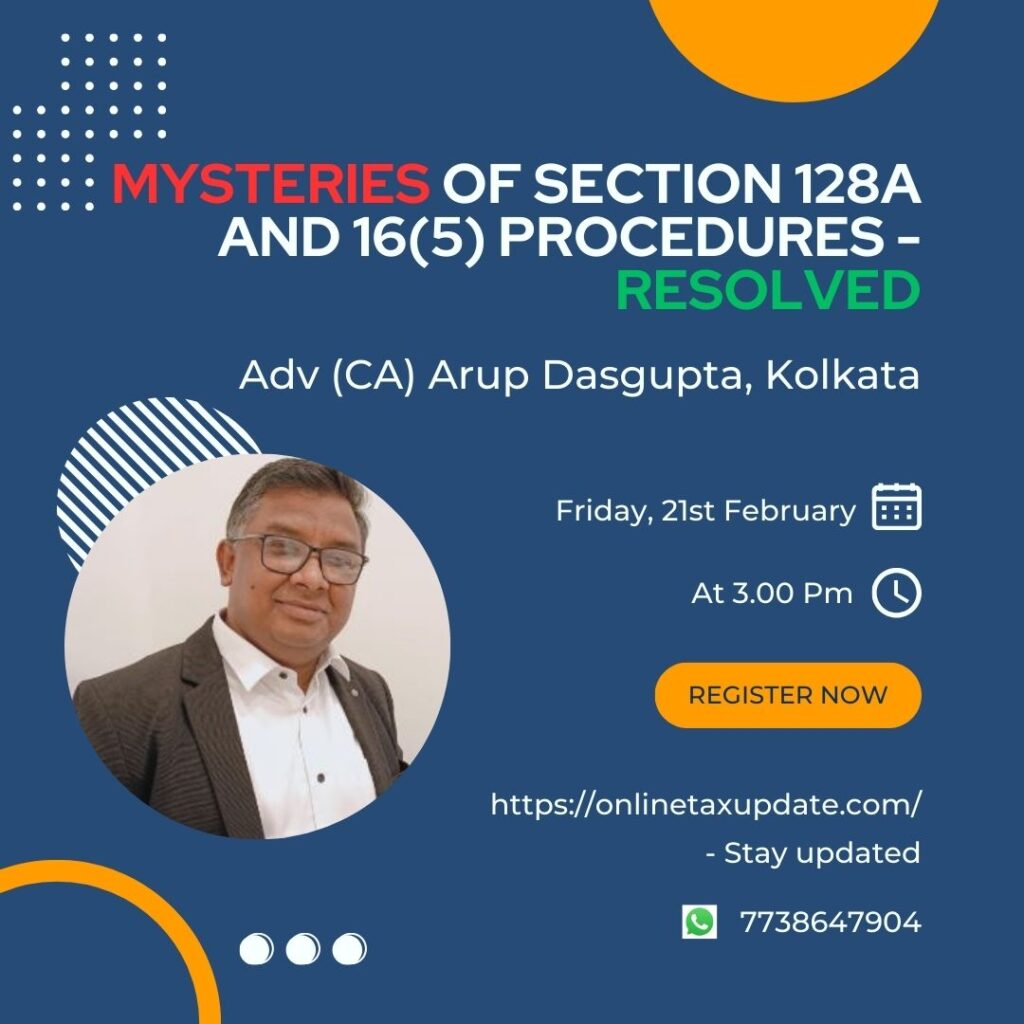

Webinar: Mysteries of Section 128A and 16(5) Procedures – Resolved

by Adv (CA) Arup Dasgupta, Kolkata

Date: 21.02.2025

Time: 3 pm to 5 pm

Tax in media

GST fraud: SC refuses to grant protection from arrest to absconding accused

The Supreme Court on Friday refused to grant protection from arrest to an “absconding” accused, stranded at Kuala Lumpur in Malaysia, following revocation of his Indian passport in a GST fraud case. A bench comprising Chief Justice Sanjiv Khanna and Justice Sanjay Kumar was urged by senior advocate Raju Ramchandran, appearing for Aarushi Aggarwal, that her husband Nishant was more than willing to come to India to join the investigation.

GST Registration Cannot Be Denied Saying Applicant Does Not Belong to the State

The Andhra Pradesh High Court ruled that GST registration cannot be denied solely on the grounds that the applicant is from another state.

VEGA (Vision for Expeditious Goods release on Arrival)

VEGA (Vision for Expeditious Goods release on Arrival) launched by Hon’ble Finance Minister Smt Nirmala Sitharaman on the occasion of celebration of International Customs Day. Under VEGA, AEO entities will be extended the facility of directly moving their import cargo to their premises, where the examination of cargo will be done.

CBIC celebrates International Customs Day with a focus on Efficiency, Security and Prosperity

The Central Board of Indirect Taxes and Customs (CBIC) celebrated International Customs Day at Nhava Sheva, Mumbai today, with the theme “Customs Delivering on its Commitment to Efficiency, Security, and Prosperity.”

No refund if ITR filed post due date in new income tax bill? I-T dept issues this clarification

Will you be eligible for a refund even if you file your ITR (income tax return) late? This concern was raised by many people due to the introduction of new Income Tax Bill 2025 in the Lok Sabha. Many experts have pointed out that the new income tax bill, which is likely to be applicable starting FY2026-27, highlights that if taxpayer does not file their income tax returns before the due date, they will not be eligible to get a refund. Experts are pointing out the same on various social media platforms.

Experts intrigued by inclusion of electoral bonds in new Income Tax Bill

Experts are intrigued by the new Income Tax Bill, 2025 retaining provisions related to electoral bonds, which were rendered unconstitutional by the Supreme Court last year, saying it could be because of legislative oversight or the government’s intention to bring it back in some other form.

Data helps Taxman unearth foreign assets worth Rs 22,000 cr

The Income Tax Department has detected ₹22,000 crore during a drive against undisclosed foreign assets and investments, a senior official told ET. It launched the drive last November based on information received under bilateral and multilateral agreements and also foreign remittance data.

See Webinar

Videos Watch here

Follow us at Twitter

Support us contribute

Subscribe Newsletter

Share this content:

Post Comment