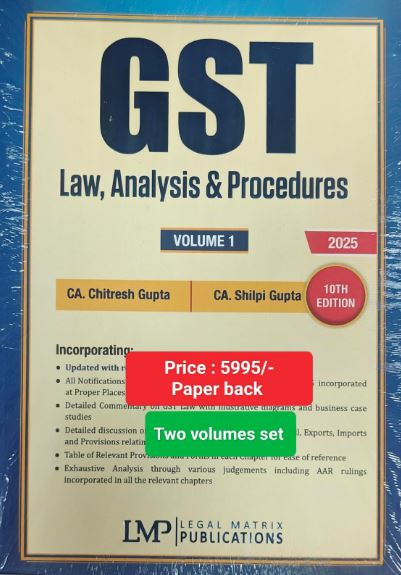

Book: GST Law, Analysis & Procedures

by CA. Chitresh Gupta and CA. Shilpi Gupta

Book title: GST Law, Analysis & Procedures

10th Edition, 2025

| Particulars | Price (Rs.) |

| Price | 5995 |

| Less: Discount @ 20% | 1200 |

| Offer Price | 4795 |

About the Book

VOLUME 1

- Chapter 1 Introduction to GST

- Chapter 2 Meaning and Scope of Supply

- Chapter 3 Administration

- Chapter 4 Levy & Collection of Tax

- Chapter 5 Classification

- Chapter 6 Composition Levy

- Chapter 7 Reverse Charge Mechanism

- Chapter 8 Exclusions and Exemptions

- Chapter 9 Imports

- Chapter 10 Exports

- Chapter 11 Time of Supply

- Chapter 12 Place of Supply

- Chapter 13 Value of Supply

- Chapter 14 Input Tax Credit

- Chapter 15 Input Service Distributor

- Chapter 16 Registration

VOLUME 2

- Chapter 17 Tax Invoice, Credit & Debit Notes

- Chapter 18 Returns

- Chapter 19 Payment of Tax

- Chapter 20 Tax Deducted at Source

- Chapter 21 Refunds

- Chapter 22 Accounts and Records

- Chapter 23 Job Work

- Chapter 24 E-Commerce and Online Information Database Access & Retrieval Services

- Chapter 25 Electronic Way Bill

- Chapter 26 Assessment

- Chapter 27 Audit

- Chapter 28 Demands and Recovery

- Chapter 29 Liability to Pay in Certain Cases

- Chapter 30 Inspection, Search, Seizure and Arrest

- Chapter 31 Offences, Penalties, Prosecution and Compounding

- Chapter 32 Appeals and Revision

- Chapter 33 Advance Ruling

- Chapter 34 Miscellaneous Provisions

- Chapter 35 Transitional Provisions

- Chapter 36 GST Compensation Cess

Share this content:

Post Comment