Latest update 30.01.2025

A. Amendment /Update

Taxpayers can opt for the Composition Scheme for FY 2025-26 via GST Portal

The GST Portal has now enabled the functionality to file the Letter of Undertaking (LUT) GST-RFD-11, for the Financial Year 2025-26.

B.Article

The Hon’ble Bombay High Court in the case of Panacea Biotec Limited Vs Union of India & Ors set aside the SCN issued and order passed relating to levy of GST on the transaction relating to assignment of leasehold rights by a lessee to third party for on account of non-consideration of reply at the time of passing of order.

Stayed granted against Notification extending limitation for adjudication

The Hon’ble Uttarakhand High Court in the case of Hindustan Construction Company Limited listed the case on February 25, 2025 along with WPMB N. 523 of 2024 and held that the effect and operation of Notification No. 56/2023 dated December 28, 2023(“the Notification”) and other consequential orders were stayed.

I-T dept raids IIFL Finance, related entities over alleged tax evasion

The Income Tax (I-T) department has launched a search operation at the offices of IIFL Finance Limited and related entities, including 360 ONE WAM (formerly IIFL Wealth) and IIFL Securities, according to a report by The Economic Times. The raids, which began on January 28, 2025, are reportedly linked to allegations of tax evasion.

Budget 2025 income tax new versus old regime: Top 7 expectations of taxpayers from FN Sitharaman

The announcement of new income tax regime in India’s Union Budget 2020 was a progressive step by the Hon’ble Finance Minister Sitharaman towards simplification and moving away from administratively heavy tax exemption regime. This paved the way for taxpayers to pay income tax at a reduced slab rate in exchange for most of the exemptions and deductions otherwise available under the old income tax regime.

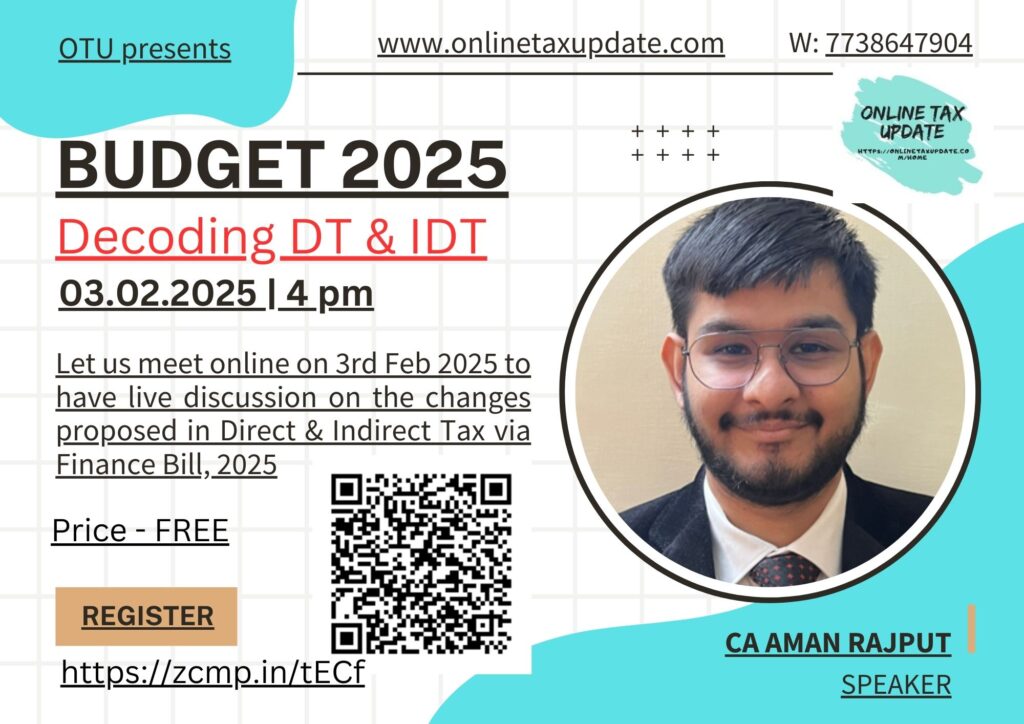

Budget 2025 – Decoding DT & IDT

Date: 3rd February, 2025

Time: 4 pm to 5:30 pm | Fees: – Free

See Webinar

Videos Watch here

Follow us at Twitter

Support us contribute

Subscribe Newsletter

Share this content:

Post Comment